- India

- /

- Gas Utilities

- /

- NSEI:GAIL

Investors Continue Waiting On Sidelines For GAIL (India) Limited (NSE:GAIL)

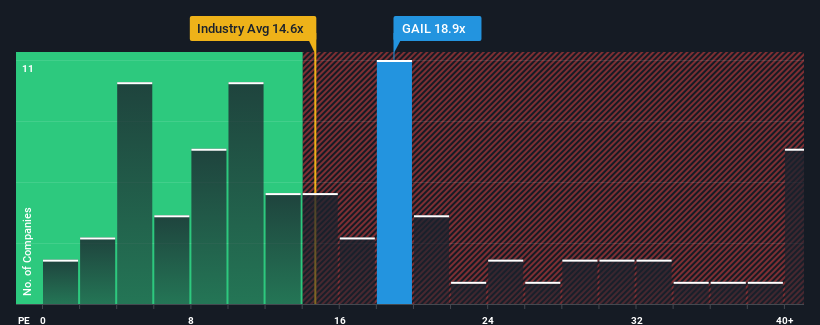

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 30x, you may consider GAIL (India) Limited (NSE:GAIL) as an attractive investment with its 18.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, GAIL (India)'s earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for GAIL (India)

Is There Any Growth For GAIL (India)?

The only time you'd be truly comfortable seeing a P/E as low as GAIL (India)'s is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 55%. The last three years don't look nice either as the company has shrunk EPS by 36% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 23% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 19% per year, which is noticeably less attractive.

In light of this, it's peculiar that GAIL (India)'s P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From GAIL (India)'s P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of GAIL (India)'s analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - GAIL (India) has 2 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GAIL

GAIL (India)

Operates as a natural gas processing and distribution company in India and internationally.

Solid track record with adequate balance sheet and pays a dividend.