There's Reason For Concern Over TVS Supply Chain Solutions Limited's (NSE:TVSSCS) Price

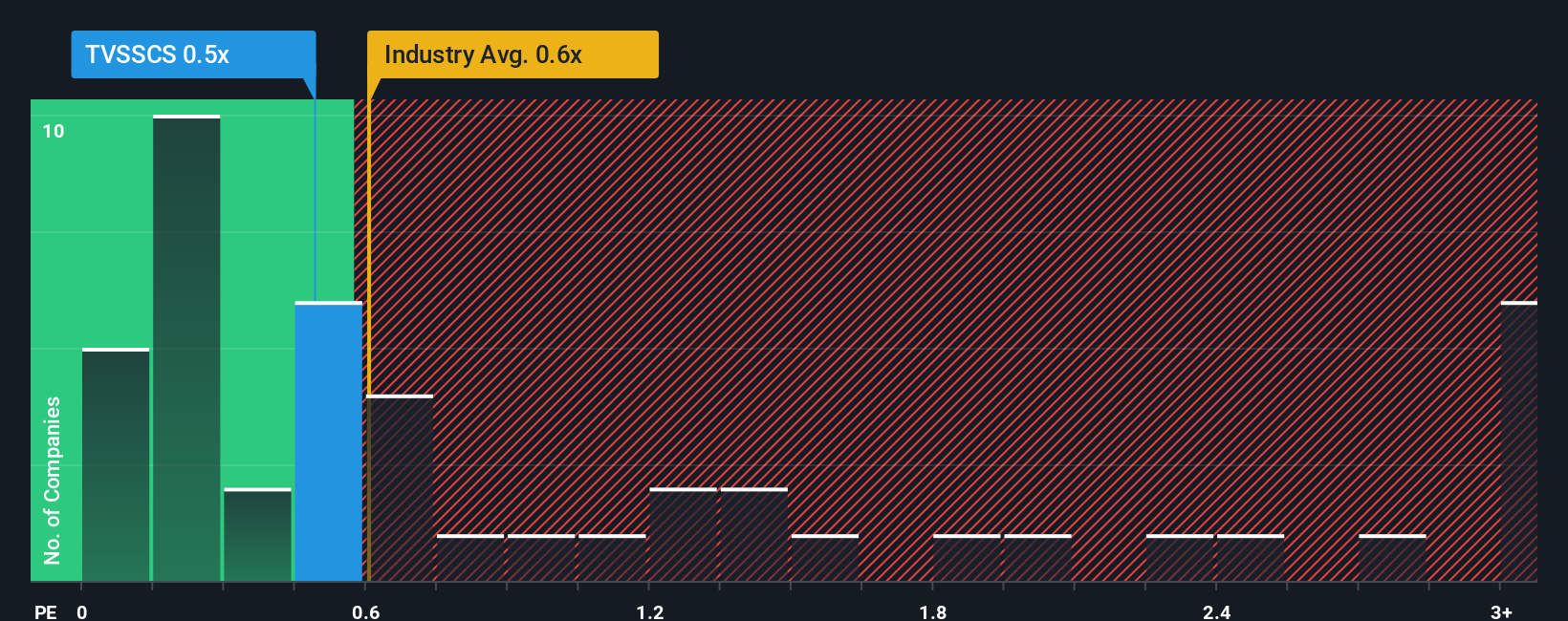

There wouldn't be many who think TVS Supply Chain Solutions Limited's (NSE:TVSSCS) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Logistics industry in India is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for TVS Supply Chain Solutions

What Does TVS Supply Chain Solutions' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, TVS Supply Chain Solutions has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think TVS Supply Chain Solutions' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, TVS Supply Chain Solutions would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.1% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 2.2% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 8.6% over the next year. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's curious that TVS Supply Chain Solutions' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On TVS Supply Chain Solutions' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that TVS Supply Chain Solutions' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for TVS Supply Chain Solutions that you should be aware of.

If these risks are making you reconsider your opinion on TVS Supply Chain Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TVS Supply Chain Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TVSSCS

TVS Supply Chain Solutions

Provides integrated supply chain solutions in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives