- India

- /

- Infrastructure

- /

- NSEI:DREDGECORP

Dredging Corporation of India Limited's (NSE:DREDGECORP) Shares Leap 31% Yet They're Still Not Telling The Full Story

Dredging Corporation of India Limited (NSE:DREDGECORP) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 151% in the last year.

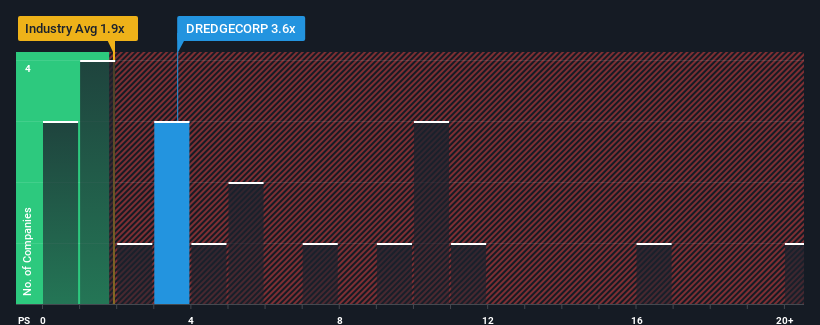

Even after such a large jump in price, Dredging Corporation of India may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.6x, since almost half of all companies in the Infrastructure industry in India have P/S ratios greater than 4.7x and even P/S higher than 11x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Dredging Corporation of India

How Dredging Corporation of India Has Been Performing

For instance, Dredging Corporation of India's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dredging Corporation of India will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

Dredging Corporation of India's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.9% shows it's about the same on an annualised basis.

With this information, we find it odd that Dredging Corporation of India is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

Dredging Corporation of India's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Dredging Corporation of India currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Having said that, be aware Dredging Corporation of India is showing 2 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DREDGECORP

Dredging Corporation of India

Provides dredging services to various ports, the Indian navy, fishing harbors, and other maritime organizations primarily in India.

Imperfect balance sheet very low.