Stock Analysis

- India

- /

- Infrastructure

- /

- NSEI:BRNL

Shareholders have faith in loss-making Bharat Road Network (NSE:BRNL) as stock climbs 15% in past week, taking three-year gain to 127%

Bharat Road Network Limited (NSE:BRNL) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In three years the stock price has launched 127% higher: a great result. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

Since it's been a strong week for Bharat Road Network shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Bharat Road Network

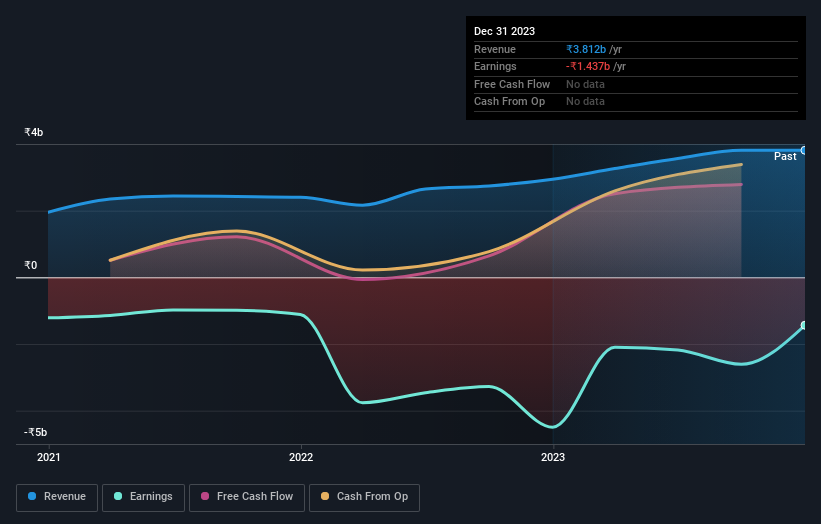

Because Bharat Road Network made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Bharat Road Network's revenue trended up 21% each year over three years. That's much better than most loss-making companies. Along the way, the share price gained 31% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Bharat Road Network is still worth investigating - successful businesses can often keep growing for long periods.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Bharat Road Network has rewarded shareholders with a total shareholder return of 104% in the last twelve months. That certainly beats the loss of about 6% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Bharat Road Network better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Bharat Road Network you should be aware of, and 1 of them is significant.

We will like Bharat Road Network better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Bharat Road Network is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BRNL

Bharat Road Network

Designs, develops, builds, owns, operates, and transfers road and related services in India.

Good value with imperfect balance sheet.