Accuracy Shipping Limited's (NSE:ACCURACY) Shares Leap 27% Yet They're Still Not Telling The Full Story

Accuracy Shipping Limited (NSE:ACCURACY) shareholders have had their patience rewarded with a 27% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

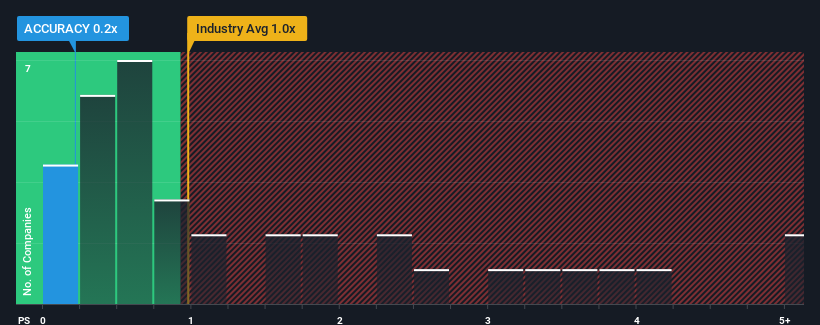

Although its price has surged higher, Accuracy Shipping's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Logistics industry in India, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Accuracy Shipping

How Has Accuracy Shipping Performed Recently?

For instance, Accuracy Shipping's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Accuracy Shipping will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Accuracy Shipping will help you shine a light on its historical performance.How Is Accuracy Shipping's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Accuracy Shipping's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 147% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Accuracy Shipping's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Accuracy Shipping's P/S?

The latest share price surge wasn't enough to lift Accuracy Shipping's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Accuracy Shipping currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Accuracy Shipping (2 can't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ACCURACY

Accuracy Shipping

Provides third party logistics solutions in India and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives