- India

- /

- Telecom Services and Carriers

- /

- NSEI:INDUSTOWER

Indus Towers Limited (NSE:INDUSTOWER) Doing What It Can To Lift Shares

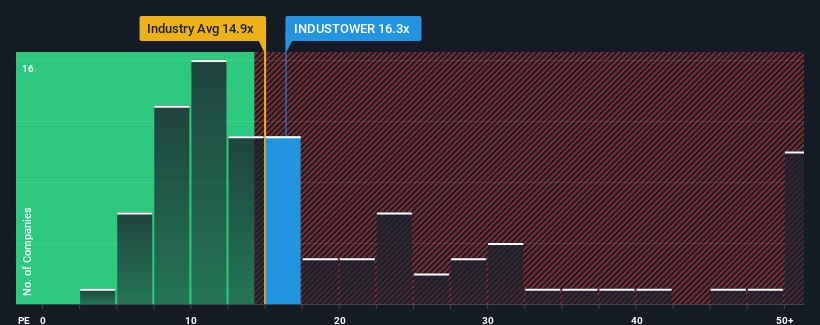

Indus Towers Limited's (NSE:INDUSTOWER) price-to-earnings (or "P/E") ratio of 16.3x might make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 30x and even P/E's above 56x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Indus Towers could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Indus Towers

Is There Any Growth For Indus Towers?

In order to justify its P/E ratio, Indus Towers would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 21% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 21% per annum over the next three years. That's shaping up to be similar to the 19% each year growth forecast for the broader market.

With this information, we find it odd that Indus Towers is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Indus Towers' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Indus Towers' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Indus Towers with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDUSTOWER

Indus Towers

A telecom infrastructure company, engages in the operation and maintenance of wireless communication towers and related infrastructures for various telecom service providers in India.

Outstanding track record and undervalued.