Stock Analysis

- India

- /

- Telecom Services and Carriers

- /

- NSEI:INDUSTOWER

Earnings growth outpaced the solid 141% return delivered to Indus Towers (NSE:INDUSTOWER) shareholders over the last year

Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Indus Towers Limited (NSE:INDUSTOWER) share price had more than doubled in just one year - up 141%. It's also good to see the share price up 56% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Looking back further, the stock price is 42% higher than it was three years ago.

Since it's been a strong week for Indus Towers shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Indus Towers

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

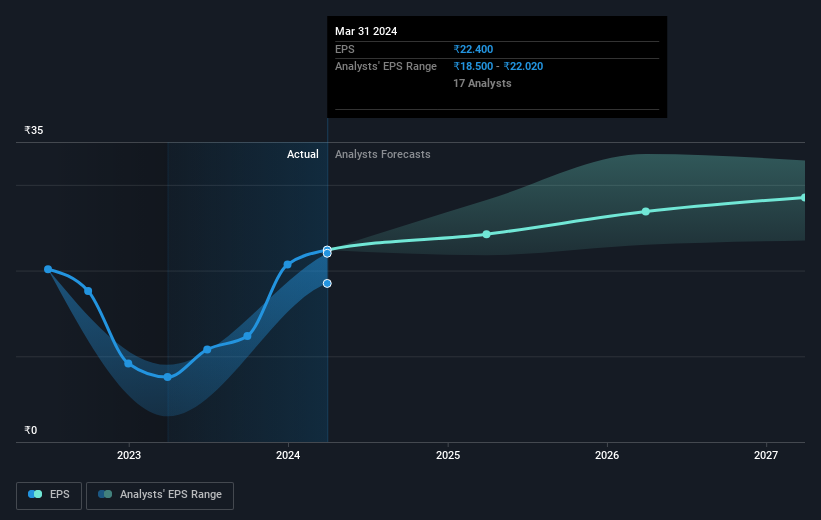

Indus Towers was able to grow EPS by 196% in the last twelve months. It's fair to say that the share price gain of 141% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Indus Towers as it was before. This could be an opportunity.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Indus Towers' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Indus Towers shareholders have received a total shareholder return of 141% over the last year. That's better than the annualised return of 8% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before deciding if you like the current share price, check how Indus Towers scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Indus Towers is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDUSTOWER

Indus Towers

Operates and maintains wireless communication towers and related infrastructures for various telecom service providers in India.

Outstanding track record with adequate balance sheet.