- India

- /

- Interactive Media and Services

- /

- NSEI:NAUKRI

High Growth Tech Stocks in India to Watch This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.1%, driven by declines in the Financials and Energy sectors of 2.1% and 5.2%, respectively, although it is up 40% over the past year with earnings forecast to grow by 17% annually. In this context, identifying high growth tech stocks can be crucial for investors looking to capitalize on sectors with strong potential despite recent market fluctuations.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Syrma SGS Technology | 21.86% | 32.67% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.11% | 42.50% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kaynes Technology India (NSEI:KAYNES)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kaynes Technology India Limited operates as an end-to-end and IoT solutions-enabled integrated electronics manufacturer in India and internationally, with a market cap of ₹330.19 billion.

Operations: Kaynes Technology India Limited generates revenue primarily from its Electronics System Design and Manufacturing (ESDM) segment, amounting to ₹20.11 billion. The company focuses on providing integrated electronics manufacturing solutions both domestically and internationally.

Kaynes Technology India has demonstrated remarkable growth, with earnings increasing by 90.7% over the past year, significantly outpacing the Electronic industry’s 22.6%. The company forecasts revenue growth of 28.5% per year and earnings growth of 31.1% annually, surpassing the Indian market's average projections of 10.1% and 17.1%, respectively. Their recent investment in a state-of-the-art electronics manufacturing facility in Hyderabad highlights their commitment to innovation and sustainability across diverse sectors like automotive and medical electronics.

- Dive into the specifics of Kaynes Technology India here with our thorough health report.

Assess Kaynes Technology India's past performance with our detailed historical performance reports.

KPIT Technologies (NSEI:KPITTECH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KPIT Technologies Limited offers embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector across various regions including the Americas, the United Kingdom, Europe, and internationally with a market cap of ₹498.51 billion.

Operations: KPIT Technologies Limited generates revenue by providing specialized software and digital solutions tailored for the automobile and mobility sectors. The company operates across various regions, including the Americas, the United Kingdom, and Europe.

KPIT Technologies has shown robust growth, with earnings increasing by 54.7% over the past year, outpacing the software industry’s 32.4%. Revenue is projected to grow at 16.1% annually, while earnings are expected to rise by 19% per year. The company recently approved a final cash dividend of ₹4.60 per share for FY2024 and reported Q1 sales of ₹13,646 million compared to ₹10,976 million a year ago. Their strategic joint venture with ZF Friedrichshafen AG in automotive middleware further strengthens their market position and innovation capabilities in this segment.

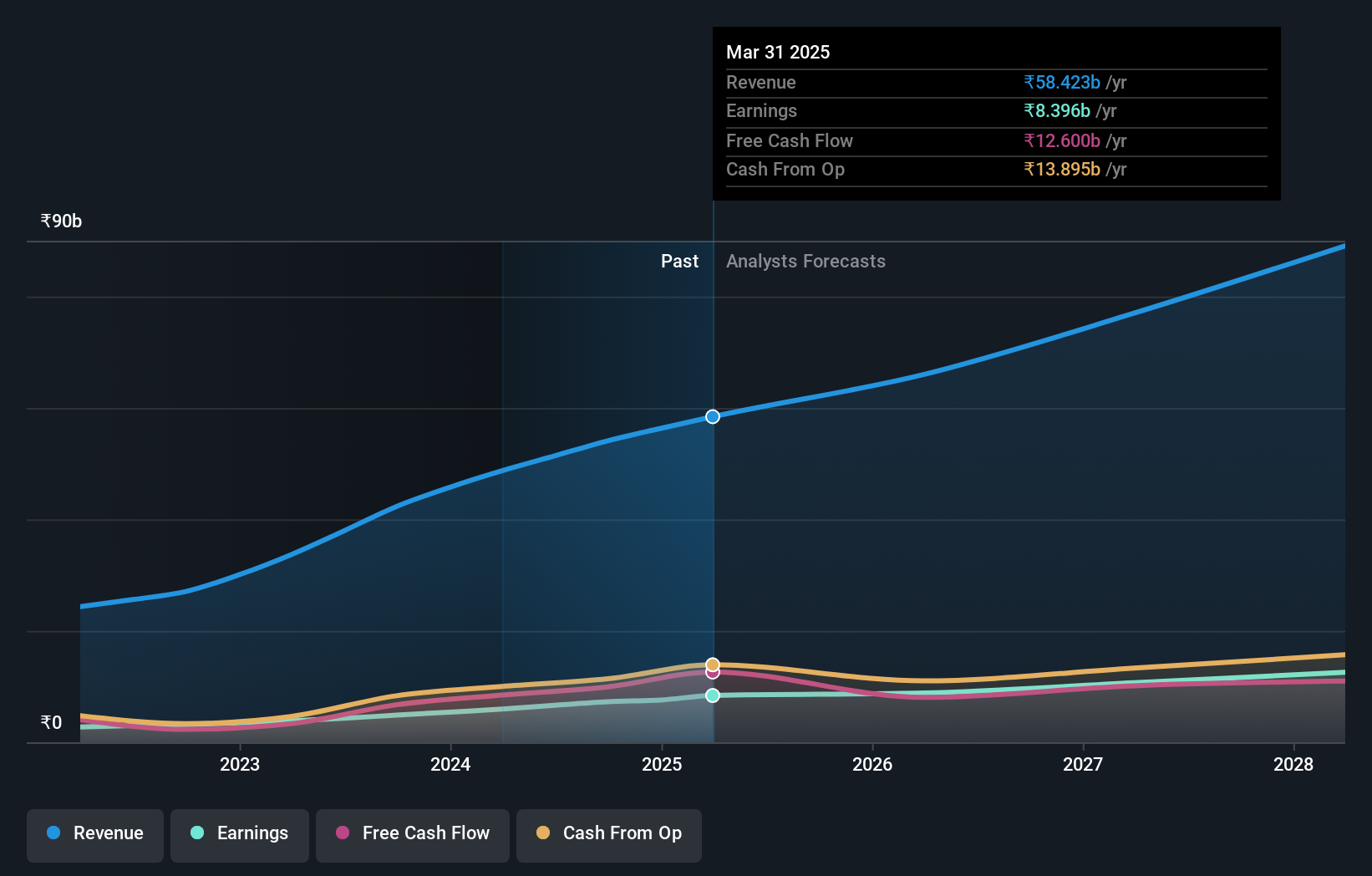

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally, with a market cap of ₹1.01 trillion.

Operations: The company generates revenue primarily from its recruitment solutions (₹19.05 billion) and real estate platform, 99acres (₹3.67 billion). The recruitment segment is the largest contributor to its revenue streams.

Info Edge (India) has demonstrated substantial growth, with earnings projected to increase by 23.6% annually, outpacing the Indian market's 17.1%. The company's revenue is expected to grow at 13% per year, driven by its diverse portfolio including Naukri.com and other digital platforms. In FY2023-24, Info Edge reported sales of ₹8.28 billion compared to ₹6.90 billion a year ago, reflecting robust performance in its core segments and strategic investments in AI-driven solutions enhancing user engagement and operational efficiency.

Next Steps

- Discover the full array of 38 Indian High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NAUKRI

Info Edge (India)

Operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives