- India

- /

- Communications

- /

- NSEI:ITI

We're Not Counting On ITI (NSE:ITI) To Sustain Its Statutory Profitability

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding ITI (NSE:ITI).

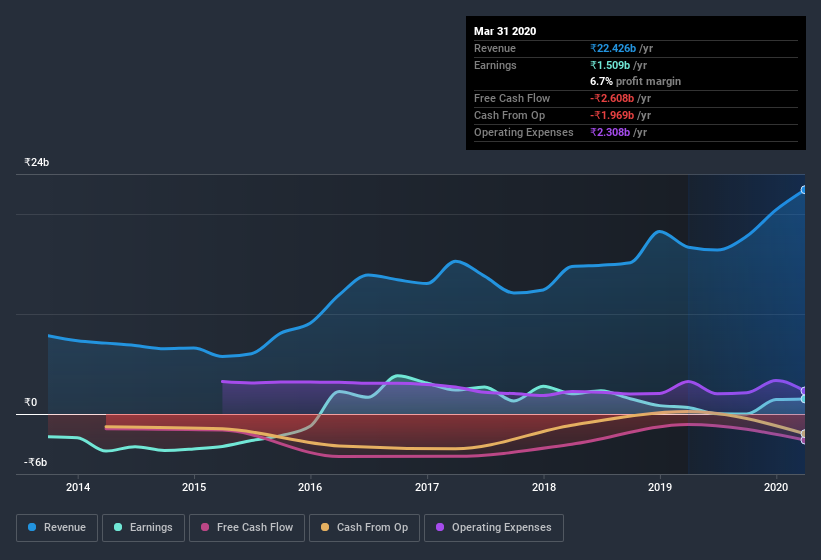

It's good to see that over the last twelve months ITI made a profit of ₹1.51b on revenue of ₹22.4b. The chart below shows how it has grown revenue over the last three years, but that profit has declined.

View our latest analysis for ITI

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. We therefore think it is well worthwhile to discuss how a recent spike in ITI's non-operating revenue has shaped its statutory profit result. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Power Of Non-Operating Revenue

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, ITI had a significant increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from ₹16.7b to ₹22.4b. The high levels of non-operating are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Our Take On ITI's Profit Performance

Because ITI's non-operating revenue spiked quite noticeably last year, you could argue that a focus on statutory profit would be too generous because profits may drop back in the future (when that non-operating revenue is not repeated). For this reason, we think that ITI's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Our analysis shows 3 warning signs for ITI (1 doesn't sit too well with us!) and we strongly recommend you look at them before investing.

Today we've zoomed in on a single data point to better understand the nature of ITI's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade ITI, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ITI

ITI

Engages in the manufacture, sale, trading, and servicing of telecommunication equipment in India.

Mediocre balance sheet and slightly overvalued.