High Growth Tech Stocks In India To Watch For Potential Gains

Reviewed by Simply Wall St

The US Federal Reserve's unexpected 50 bps rate cut and its shift in policy are boosting emerging markets, with liquidity from FIIs providing a push to India's domestic momentum despite lagging behind its Asian counterparts. In this environment, identifying high-growth tech stocks in India that can leverage both domestic and international trends becomes crucial for potential gains.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Sonata Software | 13.29% | 29.79% | ★★★★★☆ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Cyient DLM (NSEI:CYIENTDLM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cyient DLM Limited offers electronic manufacturing solutions both in India and internationally, with a market cap of ₹53.33 billion.

Operations: Cyient DLM Limited generates revenue primarily from its electronic manufacturing solutions segment, which reported ₹12.33 billion. The company operates both domestically and internationally, focusing on providing comprehensive manufacturing services.

With a robust 23.2% projected annual revenue growth, Cyient DLM stands out in India's high-tech sector, outpacing the broader market's expectation of 10.1%. This growth trajectory is complemented by an impressive earnings increase of 115.9% over the past year, significantly higher than its industry average of 23.5%. The firm has recently secured a notable contract from Boeing for aerospace components, bolstering its credentials in advanced manufacturing—a sector poised for expansion with increasing demands for aerospace and defense technology. Additionally, the strategic appointment of Mujeeb Rahiman as Head of Operations underscores Cyient DLM’s focus on enhancing operational excellence and innovation in high-volume manufacturing environments. These developments underscore Cyient DLM’s potential to leverage its R&D initiatives and industry position to sustain its upward trajectory in a competitive landscape.

- Click here to discover the nuances of Cyient DLM with our detailed analytical health report.

Gain insights into Cyient DLM's past trends and performance with our Past report.

C. E. Info Systems (NSEI:MAPMYINDIA)

Simply Wall St Growth Rating: ★★★★★★

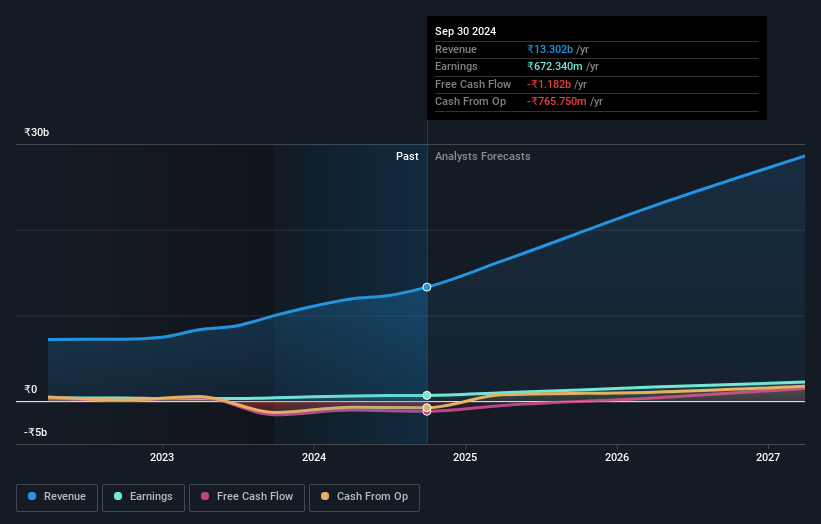

Overview: C. E. Info Systems Limited offers digital mapping, geospatial software, and location-based Internet of Things (IoT) technology solutions in India, with a market cap of ₹117.65 billion.

Operations: The company generates revenue primarily from map data and related services, including GPS navigation, location-based services, and IoT solutions, amounting to ₹3.92 billion.

C. E. Info Systems, known for its MapmyIndia platform, demonstrates a robust growth trajectory with a forecasted revenue increase of 29.9% annually, significantly outstripping the broader Indian market's growth rate of 10.1%. This performance is complemented by an expected earnings surge of 27% per year, showcasing the company's strong foothold in the tech sector. Recent strategic moves include appointing Vijay Ajmera as a Non-Executive Director and launching a partnership with Zoomcar on their Mappls app, enhancing user experience and expanding service accessibility. These initiatives not only capitalize on current tech trends but also position C.E. Info Systems to effectively harness ongoing digital transformations in navigation and location-based services.

- Take a closer look at C. E. Info Systems' potential here in our health report.

Examine C. E. Info Systems' past performance report to understand how it has performed in the past.

Newgen Software Technologies (NSEI:NEWGEN)

Simply Wall St Growth Rating: ★★★★★★

Overview: Newgen Software Technologies Limited is a software company offering products and solutions across various regions including India, Europe, the Middle East, Africa, the Asia Pacific, Australia, and the United States with a market cap of ₹197.90 billion.

Operations: Newgen Software Technologies generates revenue primarily from its software and programming segment, which accounts for ₹13.07 billion. The company operates across multiple regions including India, Europe, the Middle East, Africa, the Asia Pacific, Australia, and the United States.

Newgen Software Technologies is distinguishing itself in the Indian tech landscape, not just through its impressive revenue growth of 21.7% annually but also with an earnings increase of 22.5% per year, outpacing the broader market's expansion. These figures are bolstered by a strategic focus on R&D, where recent data shows a significant allocation towards innovation—crucial for maintaining competitive advantage in software development and AI applications. Recent appointments like Mr. Sudhir Kumar Sethi as Non-Executive Independent Director underscore a commitment to leadership that complements its technological ambitions, positioning Newgen at the forefront of financial services technology with appearances at major global conferences such as FinovateFall and the Artificial Intelligence in Financial Services Conference. This proactive approach in governance and market engagement suggests Newgen is poised to capitalize on growing demands in digital finance solutions.

Seize The Opportunity

- Unlock more gems! Our Indian High Growth Tech and AI Stocks screener has unearthed 36 more companies for you to explore.Click here to unveil our expertly curated list of 39 Indian High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAPMYINDIA

C. E. Info Systems

Provides digital mapping, geospatial software, and location-based Internet of Things (ToT) technology solutions in India.

Exceptional growth potential with excellent balance sheet.