- India

- /

- Electronic Equipment and Components

- /

- NSEI:CENTUM

Despite lower earnings than five years ago, Centum Electronics (NSE:CENTUM) investors are up 361% since then

The Centum Electronics Limited (NSE:CENTUM) share price has had a bad week, falling 11%. But that doesn't undermine the fantastic longer term performance (measured over five years). Indeed, the share price is up a whopping 348% in that time. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 11%, let's check if the fundamentals match the share price.

See our latest analysis for Centum Electronics

While Centum Electronics made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Centum Electronics saw its revenue grow at 4.9% per year. Put simply, that growth rate fails to impress. Therefore, we're a little surprised to see the share price gain has been so strong, at 35% per year, compound, over the period. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

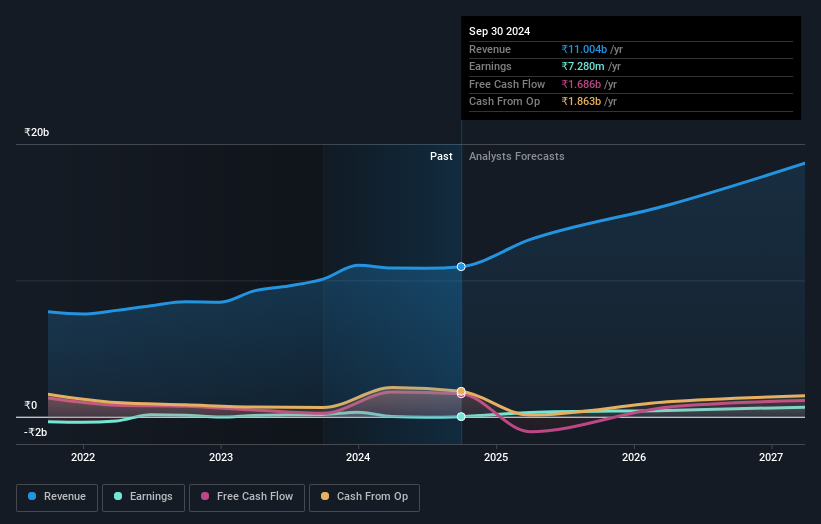

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Centum Electronics has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Centum Electronics' financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Centum Electronics the TSR over the last 5 years was 361%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Centum Electronics shareholders have received a total shareholder return of 28% over the last year. And that does include the dividend. Having said that, the five-year TSR of 36% a year, is even better. It's always interesting to track share price performance over the longer term. But to understand Centum Electronics better, we need to consider many other factors. For instance, we've identified 6 warning signs for Centum Electronics (2 are concerning) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CENTUM

Centum Electronics

Designs, manufactures, exports, and sells electronic products in India, the United Kingdom, Canada, France, Belgium, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives