Earnings Tell The Story For Zaggle Prepaid Ocean Services Limited (NSE:ZAGGLE) As Its Stock Soars 27%

Zaggle Prepaid Ocean Services Limited (NSE:ZAGGLE) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 36% in the last year.

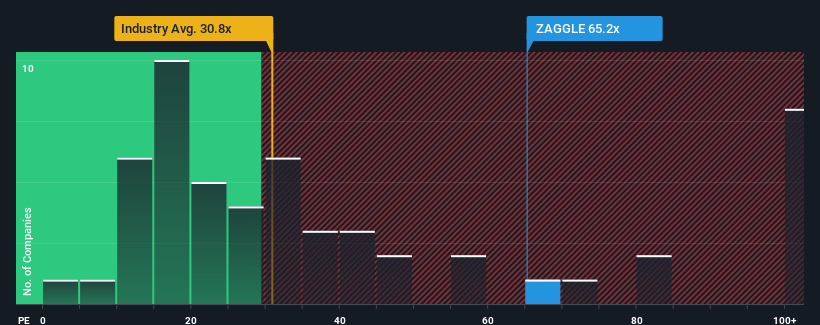

After such a large jump in price, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 27x, you may consider Zaggle Prepaid Ocean Services as a stock to avoid entirely with its 65.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in Zaggle Prepaid Ocean Services. Read for free now.Recent times have been advantageous for Zaggle Prepaid Ocean Services as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Zaggle Prepaid Ocean Services

How Is Zaggle Prepaid Ocean Services' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Zaggle Prepaid Ocean Services' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. The latest three year period has also seen an excellent 43% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 42% per annum during the coming three years according to the one analyst following the company. That's shaping up to be materially higher than the 21% per year growth forecast for the broader market.

With this information, we can see why Zaggle Prepaid Ocean Services is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Zaggle Prepaid Ocean Services' P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Zaggle Prepaid Ocean Services' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Zaggle Prepaid Ocean Services that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zaggle Prepaid Ocean Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZAGGLE

Zaggle Prepaid Ocean Services

Zaggle Prepaid Ocean Services Limited builds financial products and solutions to manage the business expenses of corporates, small and medium-sized enterprises, and startups through automated workflows.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success