Why Investors Shouldn't Be Surprised By Trust Fintech Limited's (NSE:TRUST) 66% Share Price Surge

Trust Fintech Limited (NSE:TRUST) shareholders would be excited to see that the share price has had a great month, posting a 66% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

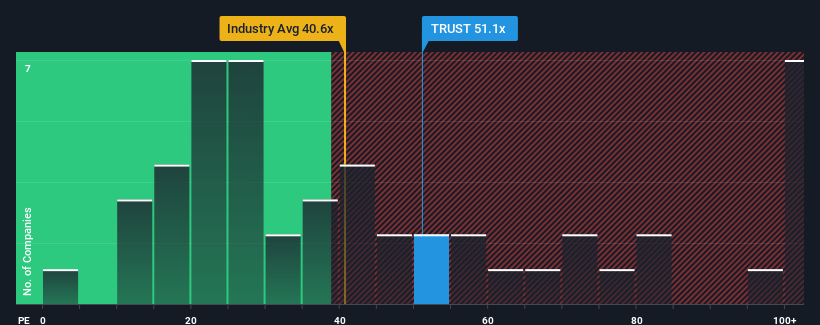

Since its price has surged higher, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 34x, you may consider Trust Fintech as a stock to potentially avoid with its 51.1x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Trust Fintech as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Trust Fintech

How Is Trust Fintech's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Trust Fintech's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 194% last year. Pleasingly, EPS has also lifted 296% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Trust Fintech's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Trust Fintech's P/E

The large bounce in Trust Fintech's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Trust Fintech maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Trust Fintech (1 shouldn't be ignored!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Trust Fintech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TRUST

Trust Fintech

Provides software solutions and services for banking, ERP implementation, customized software development, SAP B1, and offshore IT services in India and internationally.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives