The Indian market has remained flat over the past week, yet it has experienced a significant 40% rise in the last year, with earnings projected to grow by 17% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to leverage these favorable conditions.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 25.09% | 23.58% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 21.71% | ★★★★★★ |

| Sonata Software | 13.45% | 29.64% | ★★★★★☆ |

| C. E. Info Systems | 29.31% | 26.39% | ★★★★★★ |

| Firstsource Solutions | 12.35% | 20.03% | ★★★★★☆ |

| Netweb Technologies India | 33.40% | 35.82% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Avalon Technologies | 20.40% | 42.79% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Affle (India) (NSEI:AFFLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Affle (India) Limited, along with its subsidiaries, offers mobile advertisement services through IT and software development for mobiles both in India and globally, with a market cap of ₹219.65 billion.

Operations: The company generates revenue primarily from mobile advertisement services, leveraging IT and software development capabilities for mobile platforms. It operates both in India and internationally, catering to a diverse client base.

Affle (India) demonstrates robust growth in a competitive tech landscape, with revenue and earnings projections outpacing the broader Indian market at 17.6% and 23.1% annually, respectively. This performance is particularly notable given its R&D investment, which fuels innovation and aligns with industry shifts towards digital advertising solutions. Recent strategic board appointments and executive changes hint at a strengthened governance framework poised to drive future growth initiatives. Despite not outperforming the Media industry's earnings growth last year, Affle's consistent focus on enhancing its technology stack through substantial R&D spending positions it well for sustainable advances in high-demand sectors like mobile advertising.

- Get an in-depth perspective on Affle (India)'s performance by reading our health report here.

Explore historical data to track Affle (India)'s performance over time in our Past section.

Happiest Minds Technologies (NSEI:HAPPSTMNDS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Happiest Minds Technologies Limited offers IT solutions and services across various countries including India, the United States, and the United Kingdom, with a market capitalization of ₹117.74 billion.

Operations: The company generates revenue primarily from Infrastructure Management & Security Services (IMSS), amounting to ₹3.02 billion.

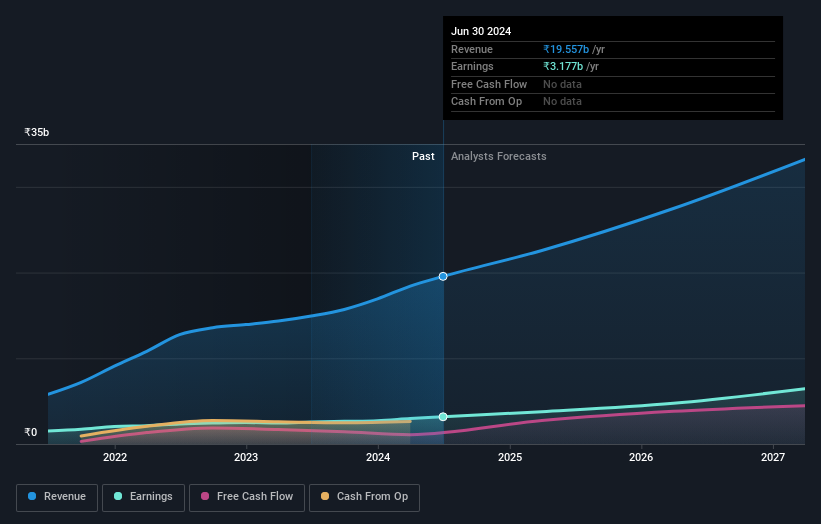

Happiest Minds Technologies is capitalizing on its robust revenue growth, projected at 21.8% annually, outpacing the Indian market's average. This surge is underpinned by strategic innovations like the launch of Secureline360, enhancing cybersecurity responses with AI-driven technologies. With R&D expenses crucially fostering these advancements, the company's commitment to reinvestment in innovation is evident as it navigates a competitive tech landscape. Despite slower earnings growth compared to industry peers last year, Happiest Minds maintains a promising trajectory with expected earnings growth of 22.2% per year, reflecting its potential in high-demand tech sectors and recent executive board enhancements aimed at bolstering governance and strategic direction.

- Click to explore a detailed breakdown of our findings in Happiest Minds Technologies' health report.

Learn about Happiest Minds Technologies' historical performance.

Tech Mahindra (NSEI:TECHM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tech Mahindra Limited offers information technology services and solutions across the Americas, Europe, India, and globally, with a market cap of ₹1.50 trillion.

Operations: The company generates revenue primarily from its information technology services and solutions offered worldwide. Its cost structure involves expenses related to service delivery, including personnel costs and infrastructure investments. The business focuses on sectors such as telecommunications, healthcare, banking, financial services, and insurance. Notably, the net profit margin has shown variability over recent periods.

Tech Mahindra's strategic focus on innovation is evident from its significant R&D expenditure, which has been instrumental in driving a robust 26.1% expected annual profit growth. The company's revenue growth forecast at 7.4% annually may not outpace the broader Indian market, but it underscores a steady demand for its tech solutions. Recently, Tech Mahindra declared an impressive interim dividend of INR 15 per share, reflecting confidence in its financial health and commitment to shareholder returns. This financial prudence combined with recent leadership enhancements positions Tech Mahindra as a resilient player amidst evolving tech landscapes.

- Click here to discover the nuances of Tech Mahindra with our detailed analytical health report.

Examine Tech Mahindra's past performance report to understand how it has performed in the past.

Next Steps

- Take a closer look at our Indian High Growth Tech and AI Stocks list of 39 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Happiest Minds Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HAPPSTMNDS

Happiest Minds Technologies

Provides IT solutions and services in India, the United States, Canada, the United Kingdom, Australia, the Netherlands, Singapore, Malaysia, New Zealand, Mexico, Africa, and the Middle East.

Flawless balance sheet with high growth potential.