Saksoft Limited's (NSE:SAKSOFT) CEO Compensation Is Looking A Bit Stretched At The Moment

Under the guidance of CEO Aditya Krishna, Saksoft Limited (NSE:SAKSOFT) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 10 August 2021. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Saksoft

Comparing Saksoft Limited's CEO Compensation With the industry

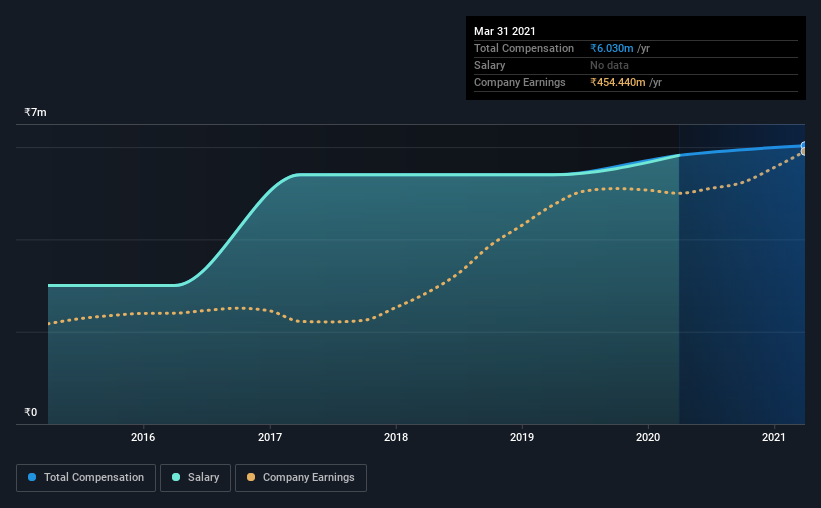

Our data indicates that Saksoft Limited has a market capitalization of ₹6.8b, and total annual CEO compensation was reported as ₹6.0m for the year to March 2021. That's a modest increase of 3.6% on the prior year. We note that the salary portion, which stands at ₹5.82m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹2.8m. This suggests that Aditya Krishna is paid more than the median for the industry. Furthermore, Aditya Krishna directly owns ₹1.5b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹5.8m | ₹5.4m | 97% |

| Other | ₹210k | ₹420k | 3% |

| Total Compensation | ₹6.0m | ₹5.8m | 100% |

On an industry level, roughly 100% of total compensation represents salary and 0.3647% is other remuneration. Saksoft is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Saksoft Limited's Growth Numbers

Saksoft Limited's earnings per share (EPS) grew 28% per year over the last three years. It achieved revenue growth of 8.4% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Saksoft Limited Been A Good Investment?

We think that the total shareholder return of 212%, over three years, would leave most Saksoft Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Aditya receives almost all of their compensation through a salary. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Saksoft that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Saksoft, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SAKSOFT

Saksoft

An information technology company, provides digital transformation solutions in Europe, the United States, the Asia Pacific, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success