Results: Persistent Systems Limited Beat Earnings Expectations And Analysts Now Have New Forecasts

It's been a good week for Persistent Systems Limited (NSE:PERSISTENT) shareholders, because the company has just released its latest quarterly results, and the shares gained 2.8% to ₹5,691. The result was positive overall - although revenues of ₹29b were in line with what the analysts predicted, Persistent Systems surprised by delivering a statutory profit of ₹20.98 per share, modestly greater than expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Persistent Systems

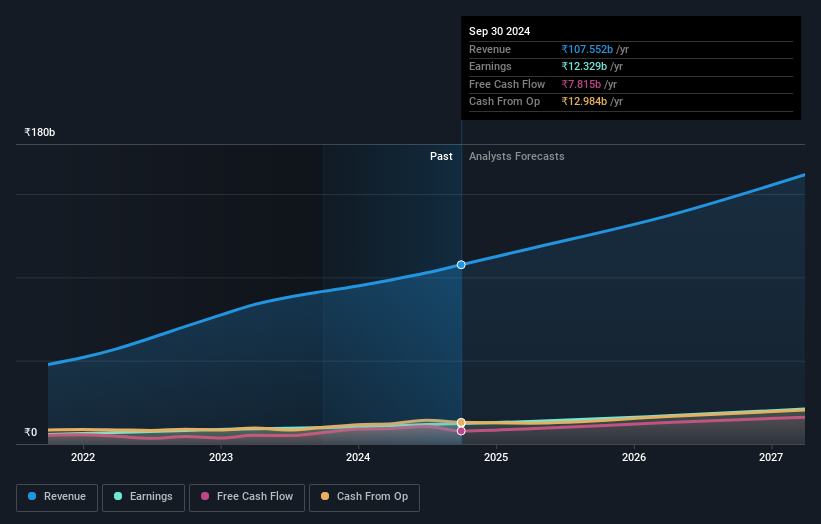

Following the latest results, Persistent Systems' 34 analysts are now forecasting revenues of ₹117.1b in 2025. This would be a notable 8.9% improvement in revenue compared to the last 12 months. Per-share earnings are expected to increase 4.0% to ₹87.26. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹116.0b and earnings per share (EPS) of ₹87.06 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at ₹5,253. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Persistent Systems analyst has a price target of ₹6,750 per share, while the most pessimistic values it at ₹3,090. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Persistent Systems' revenue growth is expected to slow, with the forecast 19% annualised growth rate until the end of 2025 being well below the historical 26% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 8.0% per year. Even after the forecast slowdown in growth, it seems obvious that Persistent Systems is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. The consensus price target held steady at ₹5,253, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Persistent Systems going out to 2027, and you can see them free on our platform here..

We also provide an overview of the Persistent Systems Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PERSISTENT

Persistent Systems

Provides software products, services, and technology solutions in India, North America, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.