- India

- /

- Professional Services

- /

- NSEI:BLS

Undiscovered Gems In India Featuring Three Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.7%, yet it remains up by an impressive 43% over the past year, with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying promising small-cap stocks that can capitalize on growth opportunities is crucial for investors seeking undiscovered gems in India.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Voith Paper Fabrics India | NA | 10.97% | 9.70% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.70% | 9.76% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Bengal & Assam | 4.48% | 1.54% | 51.11% | ★★★★★☆ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and managing administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹156.01 billion.

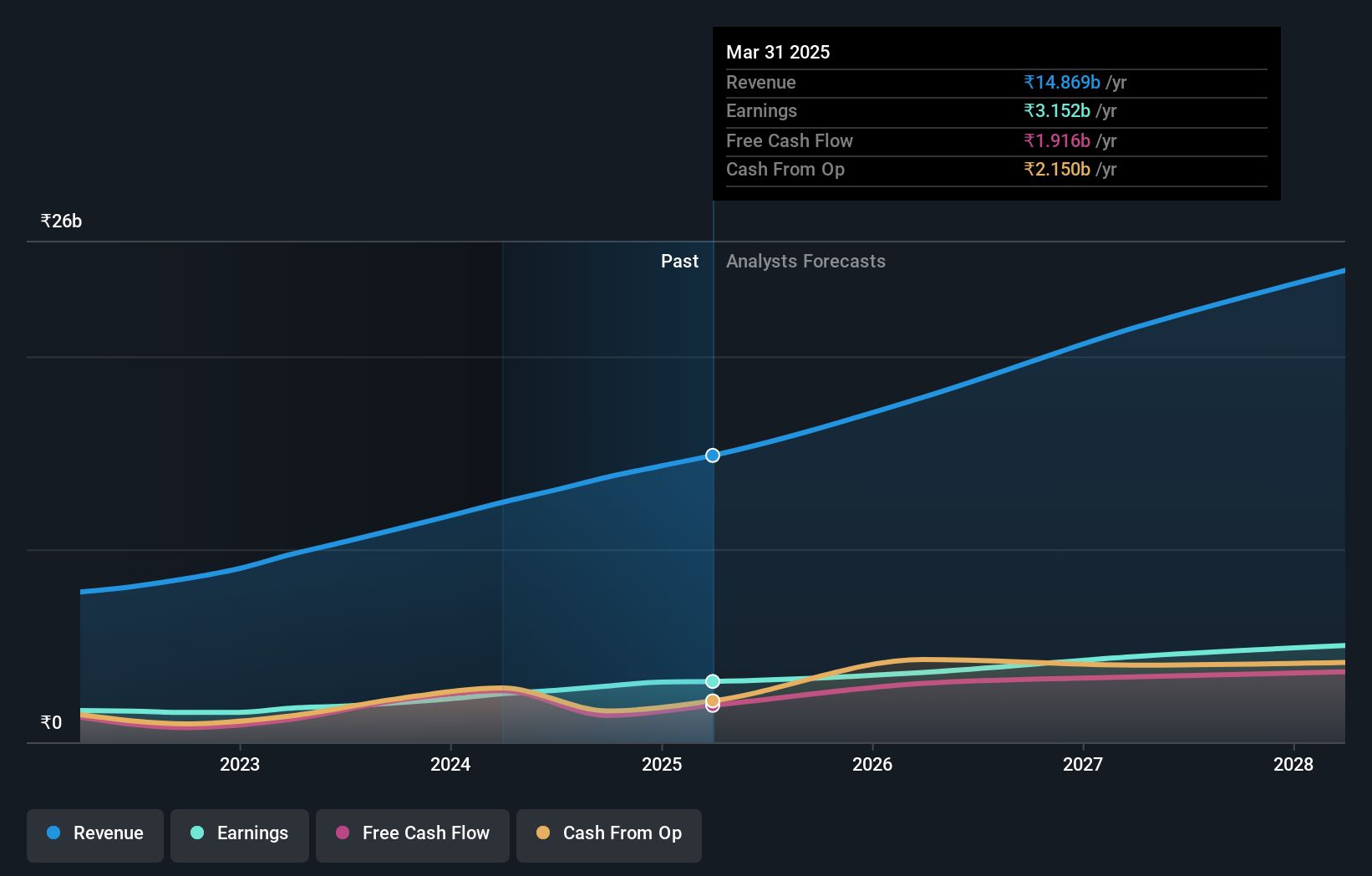

Operations: BLS International Services Limited generates revenue primarily from Visa and Consular Services (₹14.71 billion) and Digital Services (₹3.34 billion).

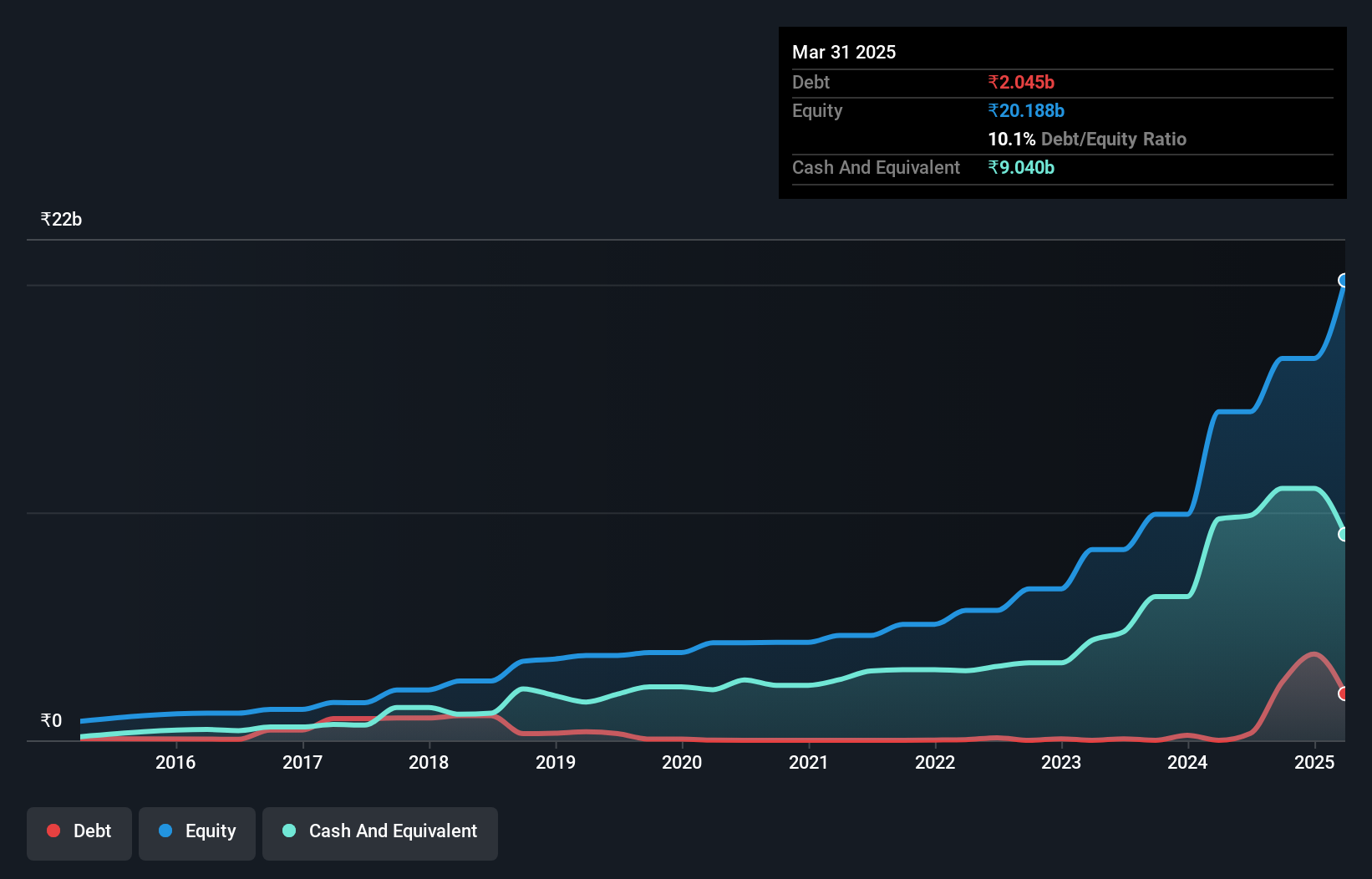

BLS International Services has shown robust growth with earnings increasing by 49.8% over the past year, outpacing the industry’s 10.4%. The debt to equity ratio improved from 7.8 to 2.1 over five years, indicating financial prudence. Recent quarterly results highlight revenue of INR 5.10 billion and net income of INR 1.14 billion, up from INR 3.91 billion and INR 689 million respectively a year ago, showcasing strong performance momentum.

Newgen Software Technologies (NSEI:NEWGEN)

Simply Wall St Value Rating: ★★★★★★

Overview: Newgen Software Technologies Limited is a software company that offers products and solutions across India, Europe, the Middle East, Africa, the Asia Pacific, Australia, and the United States with a market cap of ₹146.42 billion.

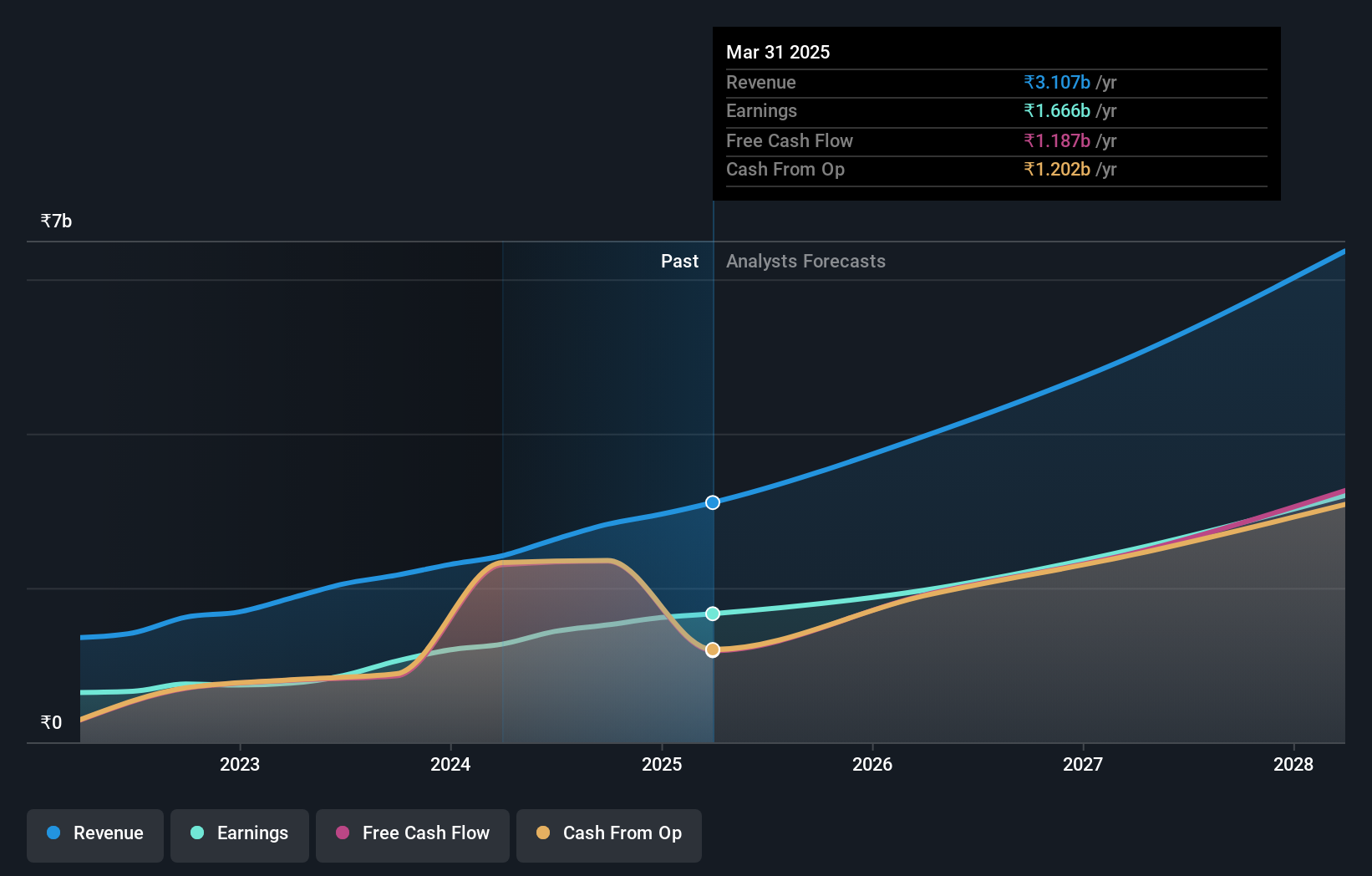

Operations: Newgen Software Technologies generates revenue primarily from its Software & Programming segment, which brought in ₹13.07 billion. The company has a market capitalization of ₹146.42 billion.

Newgen Software Technologies has demonstrated impressive financial health and growth. Over the past year, earnings surged by 43.7%, outpacing the software industry’s 28.6%. The company’s debt to equity ratio improved significantly from 16.3% to 4% over five years, reflecting robust financial management. Recent Q1 results showed revenue of INR 3,372 million and net income of INR 475 million, up from INR 302 million a year ago. Additionally, Newgen announced a final dividend of INR 4 per share for FY2024 at its AGM in July.

Tips Industries (NSEI:TIPSINDLTD)

Simply Wall St Value Rating: ★★★★★★

Overview: Tips Industries Limited engages in the acquisition and exploitation of music rights in India and internationally, with a market cap of ₹95.41 billion.

Operations: The company generates revenue primarily from its music segment, which contributed ₹2.63 billion.

Tips Industries, a prominent player in the entertainment sector, has demonstrated impressive earnings growth of 66.2% over the past year, outpacing the industry average of 11.6%. The company’s debt to equity ratio improved significantly from 12.1% to 2.8% over five years, indicating prudent financial management. Recent results show net income for Q1 2025 at INR 435.63 million compared to INR 271.01 million a year ago, with basic earnings per share rising from INR 2.11 to INR 3.4

- Get an in-depth perspective on Tips Industries' performance by reading our health report here.

Understand Tips Industries' track record by examining our Past report.

Taking Advantage

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 452 more companies for you to explore.Click here to unveil our expertly curated list of 455 Indian Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BLS International Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLS

BLS International Services

Provides outsourcing and administrative task of visa, passport, and consular services to various diplomatic missions in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion