Does HCL Technologies (NSE:HCLTECH) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like HCL Technologies (NSE:HCLTECH). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for HCL Technologies

How Fast Is HCL Technologies Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years HCL Technologies grew its EPS by 8.0% per year. That's a pretty good rate, if the company can sustain it.

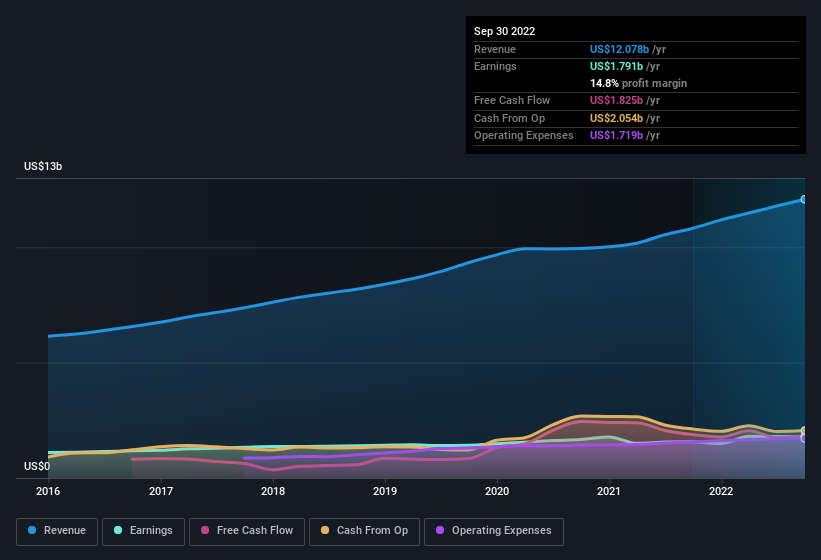

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. HCL Technologies maintained stable EBIT margins over the last year, all while growing revenue 12% to US$12b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for HCL Technologies' future EPS 100% free.

Are HCL Technologies Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth US$1.2m) this was overshadowed by a mountain of buying, totalling US$77m in just one year. We find this encouraging because it suggests they are optimistic about HCL Technologies'future. We also note that it was the CEO, MD & Director, ChinnaSwamy VijayaKumar, who made the biggest single acquisition, paying ₹70m for shares at about ₹1,161 each.

The good news, alongside the insider buying, for HCL Technologies bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$1.5b worth of shares. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.05%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add HCL Technologies To Your Watchlist?

One important encouraging feature of HCL Technologies is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. However, before you get too excited we've discovered 1 warning sign for HCL Technologies that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of HCL Technologies, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HCL Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HCLTECH

HCL Technologies

Offers software development, business process outsourcing, and infrastructure management services worldwide.

Flawless balance sheet with solid track record and pays a dividend.