What Happiest Minds Technologies Limited's (NSE:HAPPSTMNDS) P/E Is Not Telling You

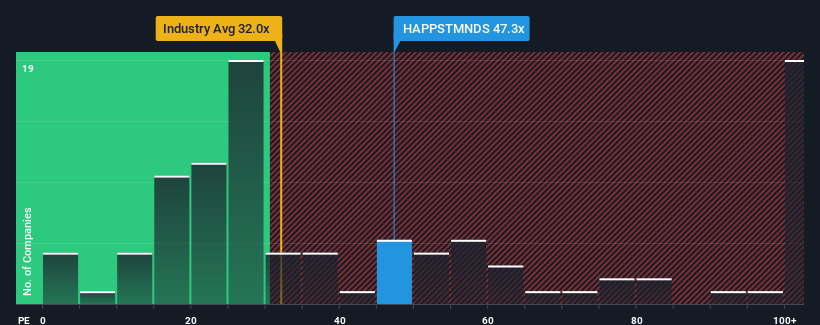

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 28x, you may consider Happiest Minds Technologies Limited (NSE:HAPPSTMNDS) as a stock to avoid entirely with its 47.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Happiest Minds Technologies hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Happiest Minds Technologies

Is There Enough Growth For Happiest Minds Technologies?

In order to justify its P/E ratio, Happiest Minds Technologies would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Regardless, EPS has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 25% during the coming year according to the seven analysts following the company. With the market predicted to deliver 24% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that Happiest Minds Technologies' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Happiest Minds Technologies' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Happiest Minds Technologies' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Happiest Minds Technologies has 2 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Happiest Minds Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HAPPSTMNDS

Happiest Minds Technologies

Provides information technology (IT) solutions and services in India, the Americas, Australia, Europe, Asia, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success