DiGiSPICE Technologies Limited (NSE:DIGISPICE) Stock Catapults 25% Though Its Price And Business Still Lag The Industry

DiGiSPICE Technologies Limited (NSE:DIGISPICE) shares have continued their recent momentum with a 25% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

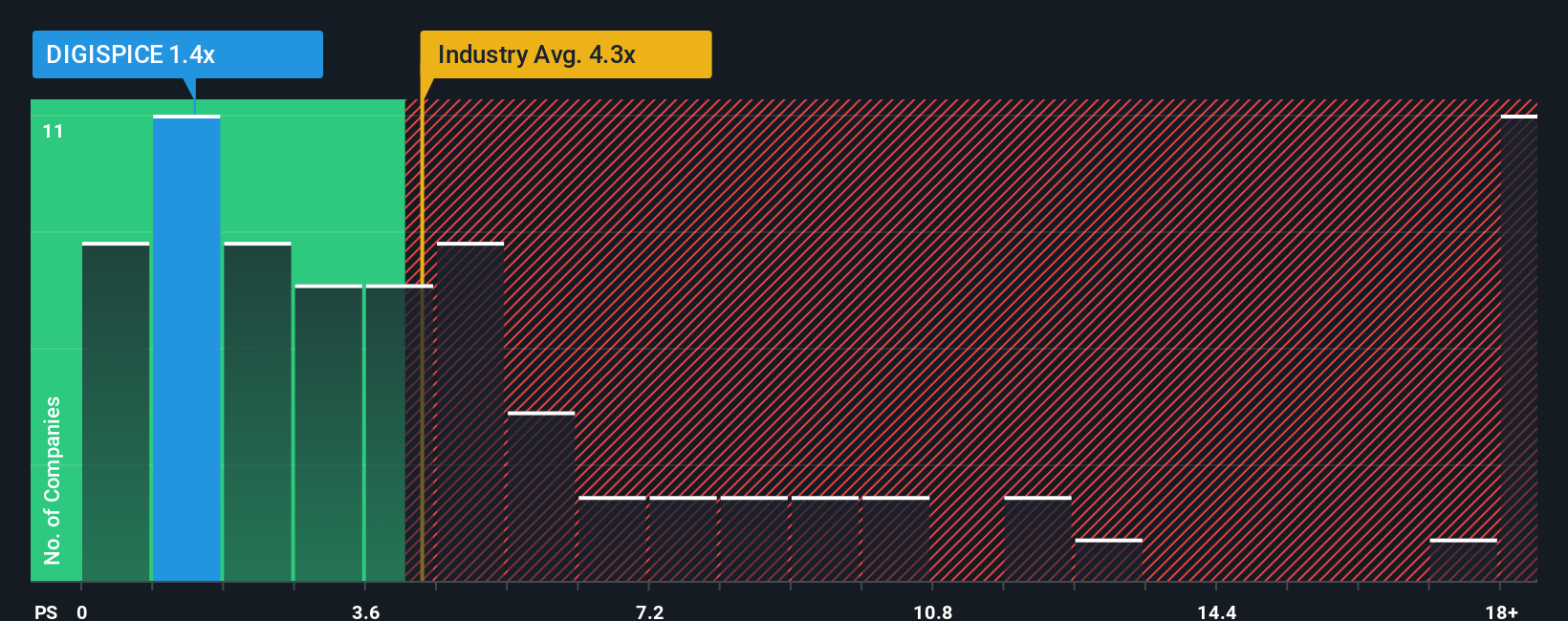

In spite of the firm bounce in price, DiGiSPICE Technologies may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Software industry in India have P/S ratios greater than 4.3x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for DiGiSPICE Technologies

What Does DiGiSPICE Technologies' Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for DiGiSPICE Technologies, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for DiGiSPICE Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For DiGiSPICE Technologies?

The only time you'd be truly comfortable seeing a P/S as depressed as DiGiSPICE Technologies' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.4% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 55% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 14% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why DiGiSPICE Technologies' P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does DiGiSPICE Technologies' P/S Mean For Investors?

Even after such a strong price move, DiGiSPICE Technologies' P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of DiGiSPICE Technologies revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for DiGiSPICE Technologies (1 is potentially serious!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DIGISPICE

DiGiSPICE Technologies

Engages in the provision of tech-enabled local payments network services in India and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives