Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Dev Information Technology Limited (NSE:DEVIT) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Dev Information Technology

What Is Dev Information Technology's Net Debt?

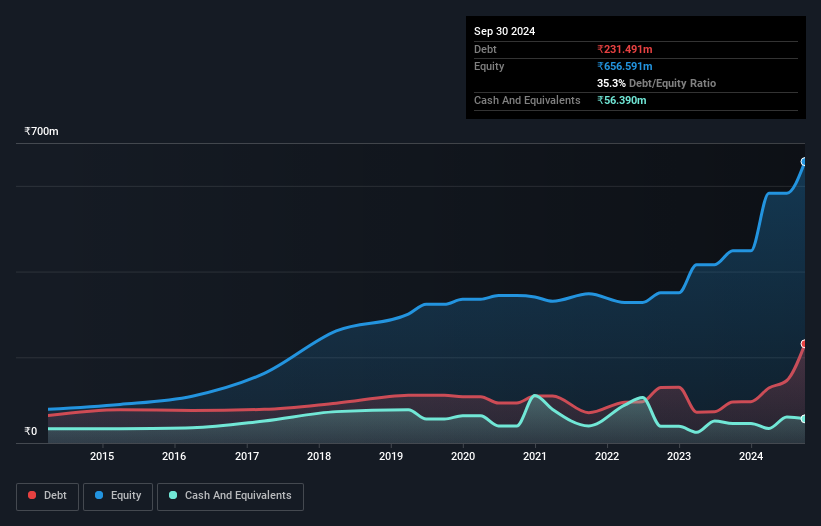

The image below, which you can click on for greater detail, shows that at September 2024 Dev Information Technology had debt of ₹231.5m, up from ₹95.9m in one year. On the flip side, it has ₹56.4m in cash leading to net debt of about ₹175.1m.

How Healthy Is Dev Information Technology's Balance Sheet?

According to the last reported balance sheet, Dev Information Technology had liabilities of ₹333.4m due within 12 months, and liabilities of ₹70.8m due beyond 12 months. Offsetting these obligations, it had cash of ₹56.4m as well as receivables valued at ₹530.0m due within 12 months. So it actually has ₹182.2m more liquid assets than total liabilities.

This short term liquidity is a sign that Dev Information Technology could probably pay off its debt with ease, as its balance sheet is far from stretched.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt sitting at just 1.4 times EBITDA, Dev Information Technology is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 7.4 times the interest expense over the last year. In addition to that, we're happy to report that Dev Information Technology has boosted its EBIT by 55%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Dev Information Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Dev Information Technology saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

The good news is that Dev Information Technology's demonstrated ability to grow its EBIT delights us like a fluffy puppy does a toddler. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. All these things considered, it appears that Dev Information Technology can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 5 warning signs for Dev Information Technology (1 is a bit unpleasant!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEVIT

Dev Information Technology

Provides information technology enabled services in India, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion