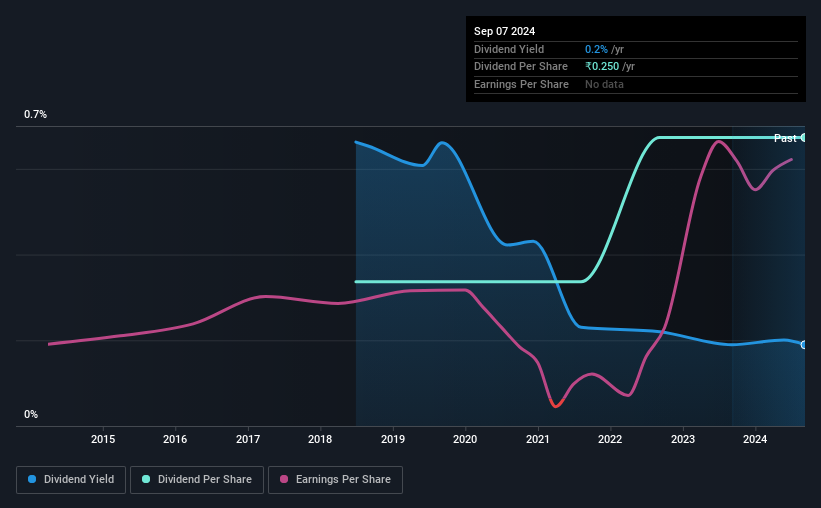

Dev Information Technology Limited (NSE:DEVIT) will pay a dividend of ₹0.25 on the 30th of October. This means the annual payment will be 0.2% of the current stock price, which is lower than the industry average.

Check out our latest analysis for Dev Information Technology

Dev Information Technology's Payment Could Potentially Have Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Prior to this announcement, Dev Information Technology's earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share could rise by 161.5% over the next year if the trend from the last few years continues. Assuming the dividend continues along recent trends, we think the payout ratio could be 2.1% by next year, which is in a pretty sustainable range.

Dev Information Technology Doesn't Have A Long Payment History

Dev Information Technology's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The annual payment during the last 6 years was ₹0.125 in 2018, and the most recent fiscal year payment was ₹0.25. This means that it has been growing its distributions at 12% per annum over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that Dev Information Technology has been growing its earnings per share at 162% a year over the past three years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

Our Thoughts On Dev Information Technology's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Dev Information Technology's payments, as there could be some issues with sustaining them into the future. While Dev Information Technology is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for Dev Information Technology that investors need to be conscious of moving forward. Is Dev Information Technology not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEVIT

Dev Information Technology

Provides information technology enabled services in India, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion