Further Upside For Allied Digital Services Limited (NSE:ADSL) Shares Could Introduce Price Risks After 27% Bounce

Allied Digital Services Limited (NSE:ADSL) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 70% in the last year.

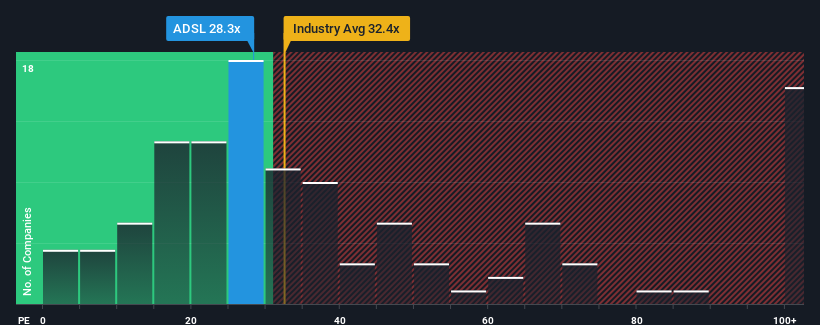

Even after such a large jump in price, it's still not a stretch to say that Allied Digital Services' price-to-earnings (or "P/E") ratio of 28.3x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Allied Digital Services could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Allied Digital Services

Is There Some Growth For Allied Digital Services?

There's an inherent assumption that a company should be matching the market for P/E ratios like Allied Digital Services' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 37% as estimated by the sole analyst watching the company. With the market only predicted to deliver 26%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Allied Digital Services' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Allied Digital Services' P/E?

Allied Digital Services appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Allied Digital Services currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Allied Digital Services, and understanding them should be part of your investment process.

If you're unsure about the strength of Allied Digital Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ADSL

Allied Digital Services

Designs, develops, deploys, and delivers end-to-end IT infrastructure services and digital solutions in India, rest of Asia, the United States, Australia, Europe, and the Middle East.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives