Stock Analysis

- India

- /

- General Merchandise and Department Stores

- /

- NSEI:SHOPERSTOP

Is Shoppers Stop (NSE:SHOPERSTOP) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Shoppers Stop Limited (NSE:SHOPERSTOP) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Shoppers Stop

What Is Shoppers Stop's Net Debt?

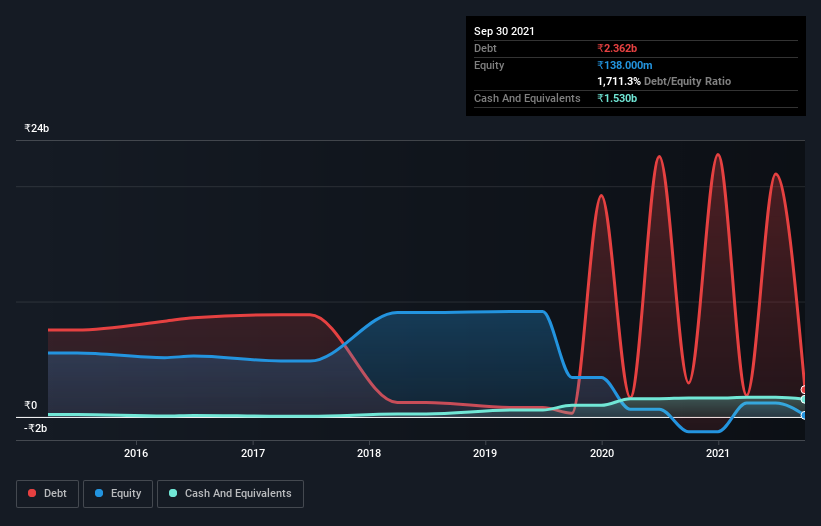

You can click the graphic below for the historical numbers, but it shows that Shoppers Stop had ₹2.36b of debt in September 2021, down from ₹2.94b, one year before. On the flip side, it has ₹1.53b in cash leading to net debt of about ₹831.3m.

How Strong Is Shoppers Stop's Balance Sheet?

The latest balance sheet data shows that Shoppers Stop had liabilities of ₹18.2b due within a year, and liabilities of ₹16.6b falling due after that. On the other hand, it had cash of ₹1.53b and ₹381.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹32.9b.

This is a mountain of leverage relative to its market capitalization of ₹40.0b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Shoppers Stop can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Shoppers Stop wasn't profitable at an EBIT level, but managed to grow its revenue by 6.2%, to ₹22b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Shoppers Stop had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at ₹1.7b. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of ₹1.6b into a profit. So we do think this stock is quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Shoppers Stop , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're helping make it simple.

Find out whether Shoppers Stop is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHOPERSTOP

Shoppers Stop

Engages in the retail of various household and consumer products through retail and departmental stores in India.

High growth potential and slightly overvalued.