- India

- /

- Healthcare Services

- /

- NSEI:JSLL

Discovering India's Hidden Stock Gems For Potential Portfolio Growth

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 4.5% drop, yet it remains up by 38% over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying stocks that are undervalued or overlooked can offer potential opportunities for portfolio growth amidst fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Goldiam International | 0.74% | 10.81% | 15.85% | ★★★★★★ |

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| Kaycee Industries | 17.35% | 19.50% | 34.62% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

D. P. Abhushan (NSEI:DPABHUSHAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: D. P. Abhushan Limited operates in the manufacturing, sale, and trading of gold, diamond, platinum, silver, and other precious metals and ornaments in India with a market cap of ₹41.11 billion.

Operations: The primary revenue stream for D. P. Abhushan comes from its gems and jewellery segment, generating approximately ₹23.74 billion. The company's market cap stands at ₹41.11 billion, indicating a significant presence in the precious metals and ornaments sector in India.

D. P. Abhushan, a small cap player in the specialty retail sector, has shown impressive growth with earnings increasing by 48% over the past year, surpassing industry growth of 29%. The company's debt to equity ratio improved significantly from 187% to 73% over five years, though its net debt to equity ratio remains high at 61%. Recent expansions include a new showroom in Ajmer spanning four floors and catering to growing demand for jewelry. Despite not being free cash flow positive, its interest payments are well covered by EBIT at a multiple of 9.3x, indicating strong financial management.

EPACK Durable (NSEI:EPACK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPACK Durable Limited specializes in the manufacturing of original design room air conditioners in India and has a market capitalization of ₹391.64 billion.

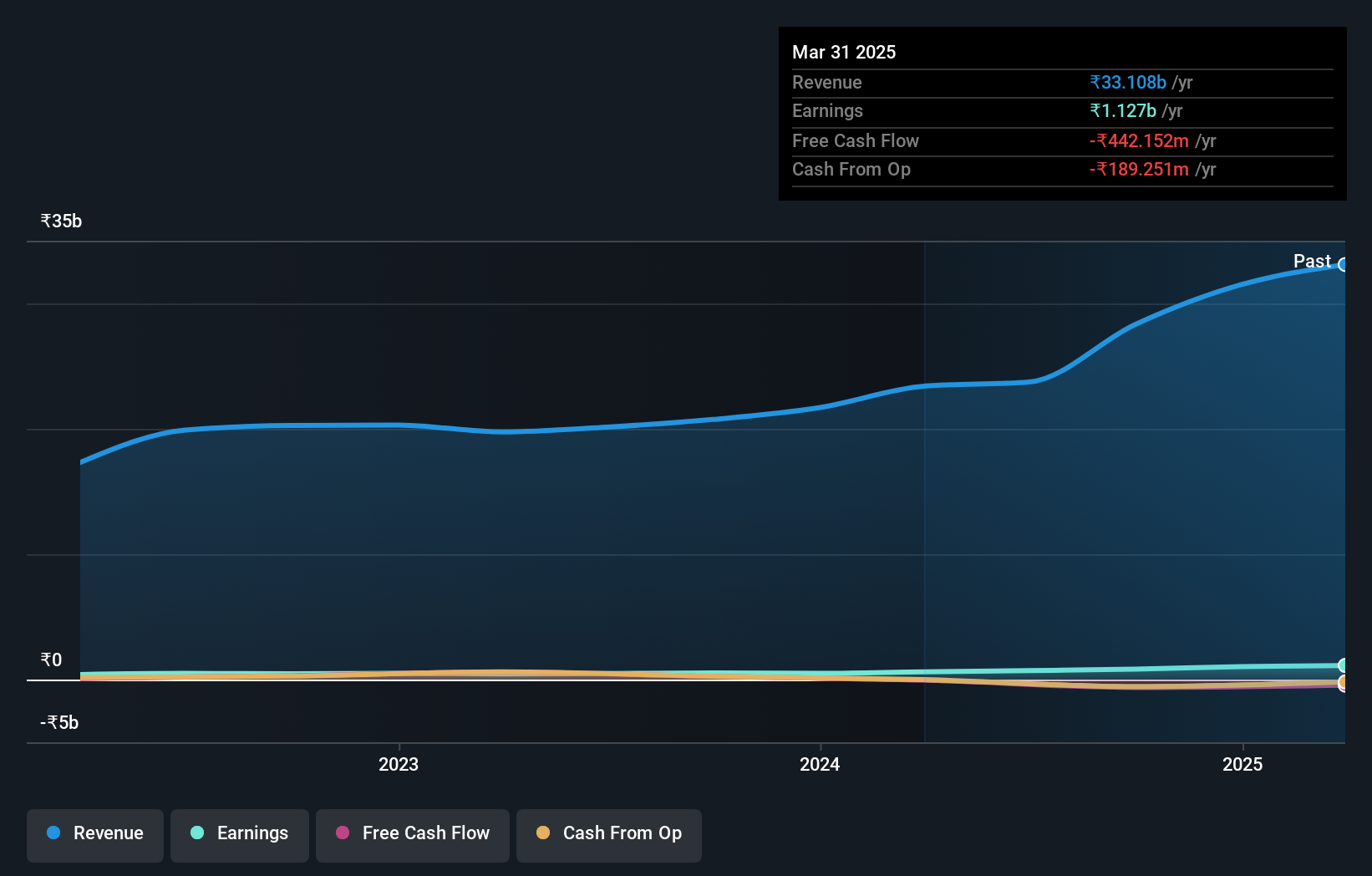

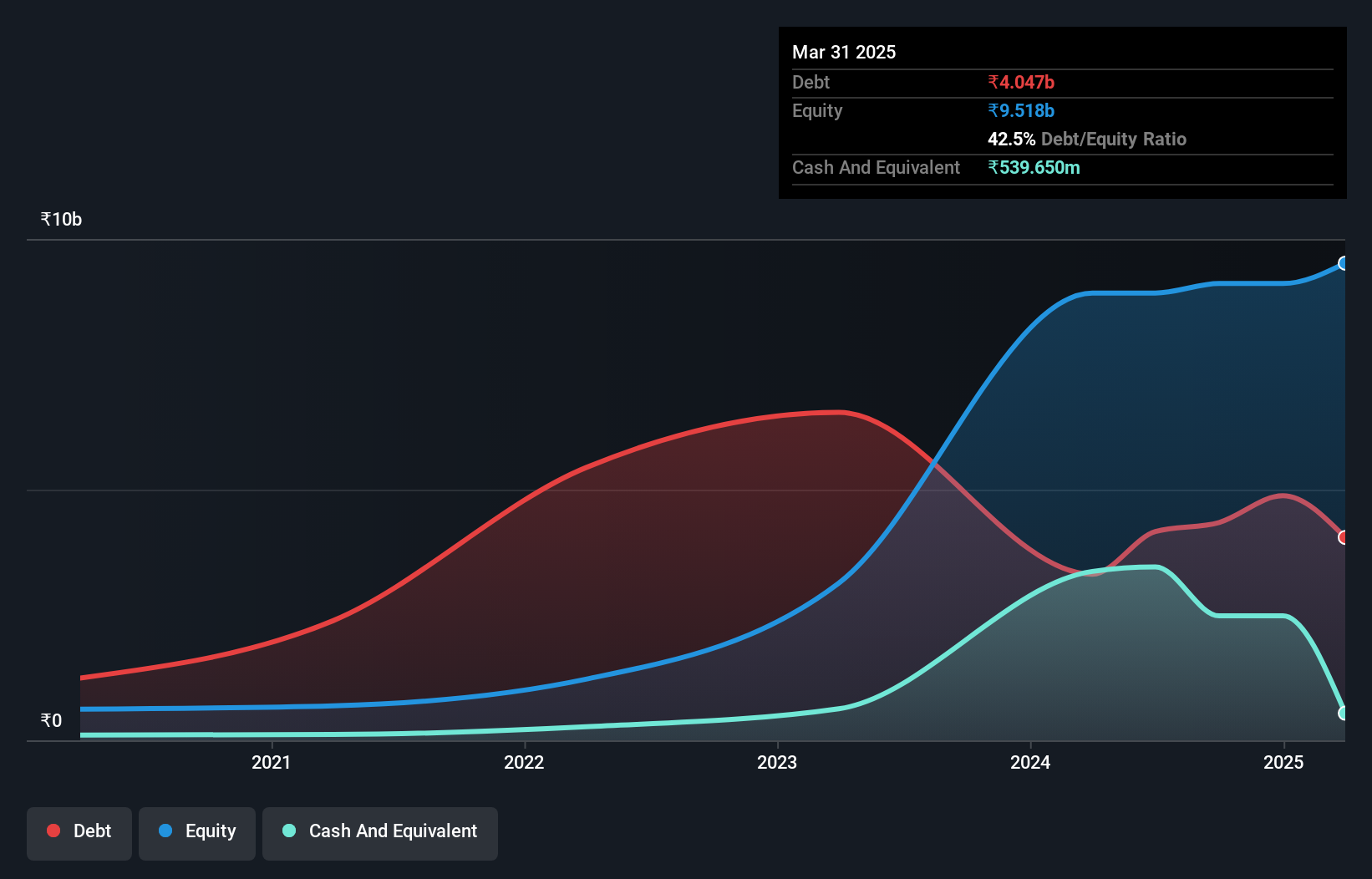

Operations: EPACK Durable Limited generates revenue primarily from the manufacturing of electronic goods, amounting to ₹17.57 billion.

EPACK Durable, a promising player in India's consumer durables sector, has shown remarkable earnings growth of 43% over the past year, outpacing the industry average of 17%. The company maintains a satisfactory net debt to equity ratio of 8%, indicating prudent financial management. Despite interest payments not being well covered by EBIT at 2.3 times coverage, EPACK's strategic alliances with Hisense and Panasonic signal robust expansion opportunities. Recent partnerships aim to enhance manufacturing capabilities and asset utilization, potentially boosting future turnover. With high-quality earnings reported, EPACK is poised for continued success in its niche market.

- Click to explore a detailed breakdown of our findings in EPACK Durable's health report.

Understand EPACK Durable's track record by examining our Past report.

Jeena Sikho Lifecare (NSEI:JSLL)

Simply Wall St Value Rating: ★★★★★★

Overview: Jeena Sikho Lifecare Limited is engaged in trading ayurvedic medicines in India and has a market cap of ₹39.72 billion.

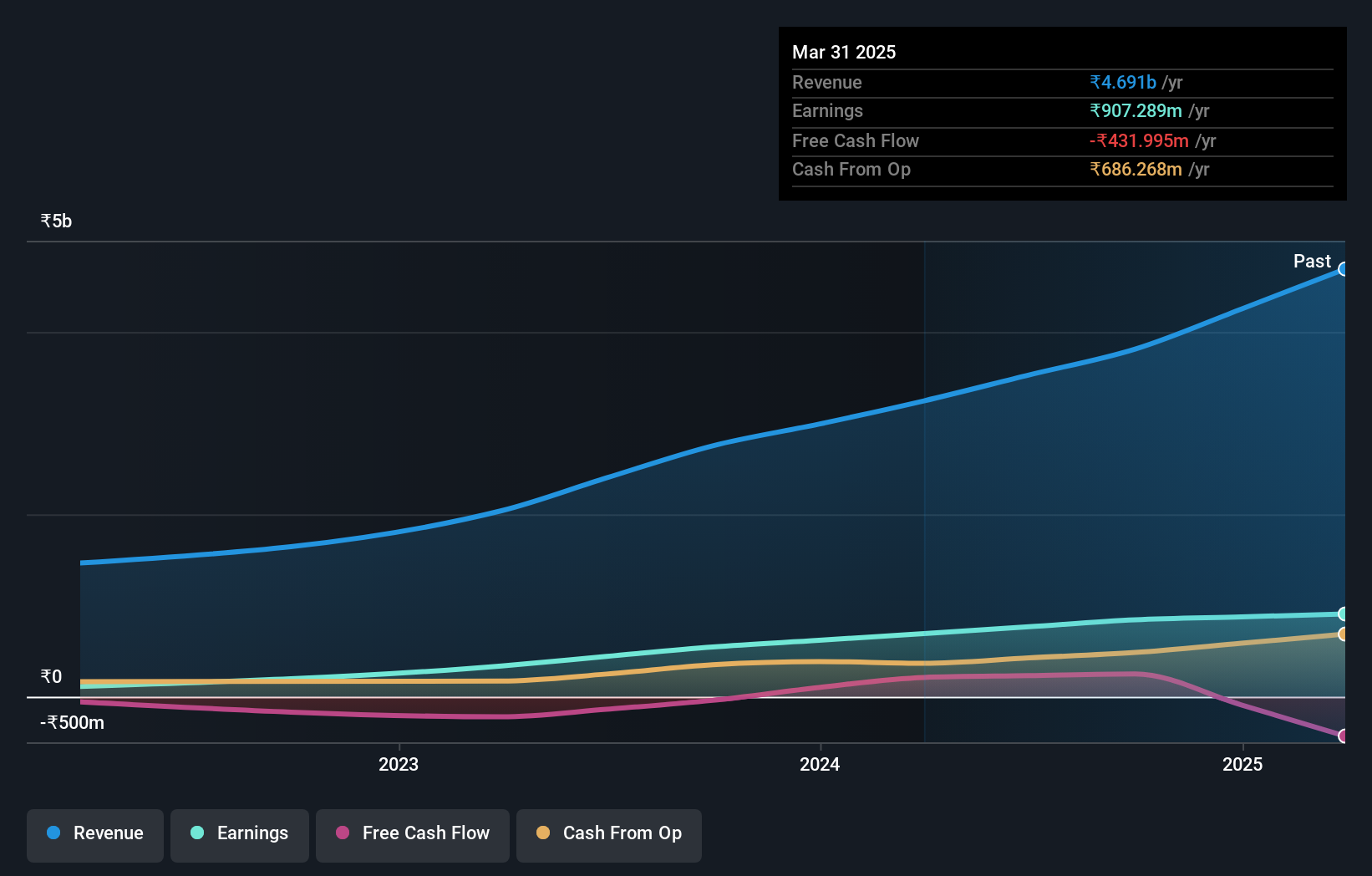

Operations: The primary revenue stream for Jeena Sikho Lifecare comes from trading ayurvedic medicines and providing ayurvedic therapies, generating revenue of ₹3.24 billion. The company's market cap stands at ₹39.72 billion.

Jeena Sikho Lifecare, a dynamic player in India's healthcare sector, is making waves with its impressive earnings growth of 105.1% over the past year, significantly outpacing the industry average of 19.4%. The company has successfully slashed its debt to equity ratio from a hefty 195.2% to just 0.3% over five years, showcasing prudent financial management. Recent expansions include new Shuddhi Ayurveda Panchkarma Hospitals across multiple locations, bolstering their footprint and services offered. With more cash than total debt and positive free cash flow standing at INR 211 million as of March 2024, JSLL's financial health appears robust for future endeavors.

- Click here to discover the nuances of Jeena Sikho Lifecare with our detailed analytical health report.

Explore historical data to track Jeena Sikho Lifecare's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 458 companies within our Indian Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JSLL

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026