- India

- /

- Specialty Stores

- /

- NSEI:ARVINDFASN

Aether Industries Leads Three Indian Exchange Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Indian market has shown remarkable resilience, remaining stable over the last week and achieving a significant 45% increase over the past 12 months with earnings projected to grow by 16% annually. In such a thriving environment, stocks like Aether Industries that combine robust growth prospects with high insider ownership are particularly compelling, suggesting strong confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 34.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.2% |

Here we highlight a subset of our preferred stocks from the screener.

Aether Industries (NSEI:AETHER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aether Industries Limited, with a market cap of ₹117.49 billion, specializes in manufacturing and distributing advanced intermediates and specialty chemicals both domestically in India and internationally.

Operations: The company generates revenue primarily through three segments: Contract Manufacturing at ₹1.53 billion, Large Scale Manufacturing at ₹3.56 billion, and Contract Research and Manufacturing Services (CRAMS) at ₹0.83 billion.

Insider Ownership: 31.1%

Earnings Growth Forecast: 40.9% p.a.

Aether Industries, a growth company with high insider ownership in India, is experiencing robust expansion. Forecasted to grow earnings by 40.87% annually and revenue by 30.6% per year, it outpaces the Indian market significantly. However, its profit margins have dipped from 19.9% to 13.8%. Recently, Aether secured a strategic supply agreement with Baker Hughes, enhancing its role in global and domestic markets under the Make in India initiative.

- Navigate through the intricacies of Aether Industries with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Aether Industries is trading beyond its estimated value.

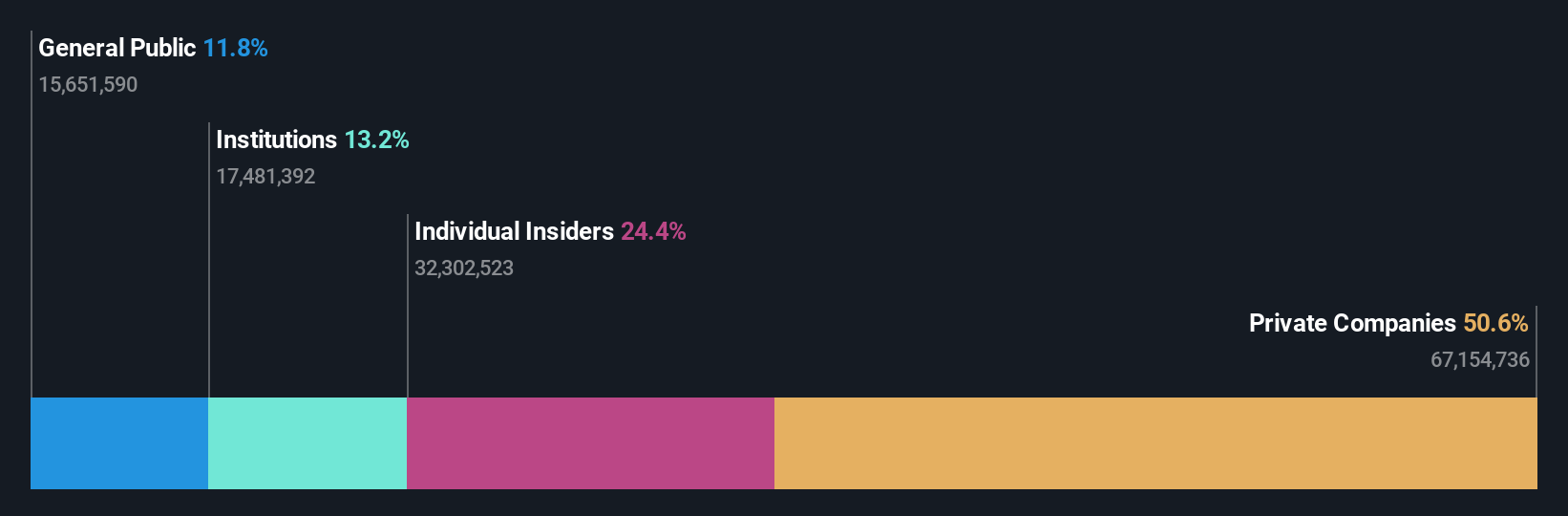

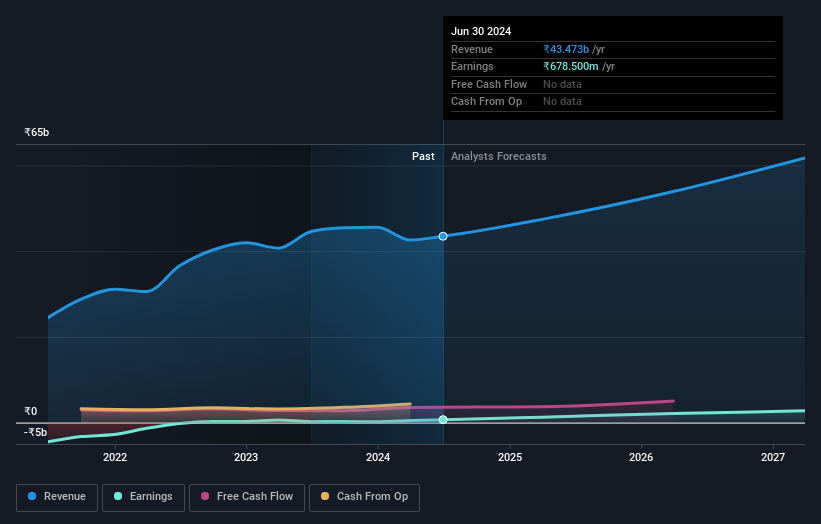

Arvind Fashions (NSEI:ARVINDFASN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arvind Fashions Limited is an Indian company specializing in the retail of garments, cosmetics, and accessories, with a market capitalization of approximately ₹67.87 billion.

Operations: The company's revenue from branded apparel, including garments and accessories, totals approximately ₹42.59 billion.

Insider Ownership: 13.5%

Earnings Growth Forecast: 60.8% p.a.

Arvind Fashions, a company with high insider ownership in India, shows promising growth with earnings forecasted to rise by 60.78% annually. Its revenue is expected to grow at 12% per year, outpacing the Indian market's 9.7%. However, its Return on Equity is projected to be low at 15.8% in three years. Recent activities include a proposed dividend of INR 1.25 per share and consistent earnings growth over the past year by 33.1%.

- Take a closer look at Arvind Fashions' potential here in our earnings growth report.

- Our expertly prepared valuation report Arvind Fashions implies its share price may be too high.

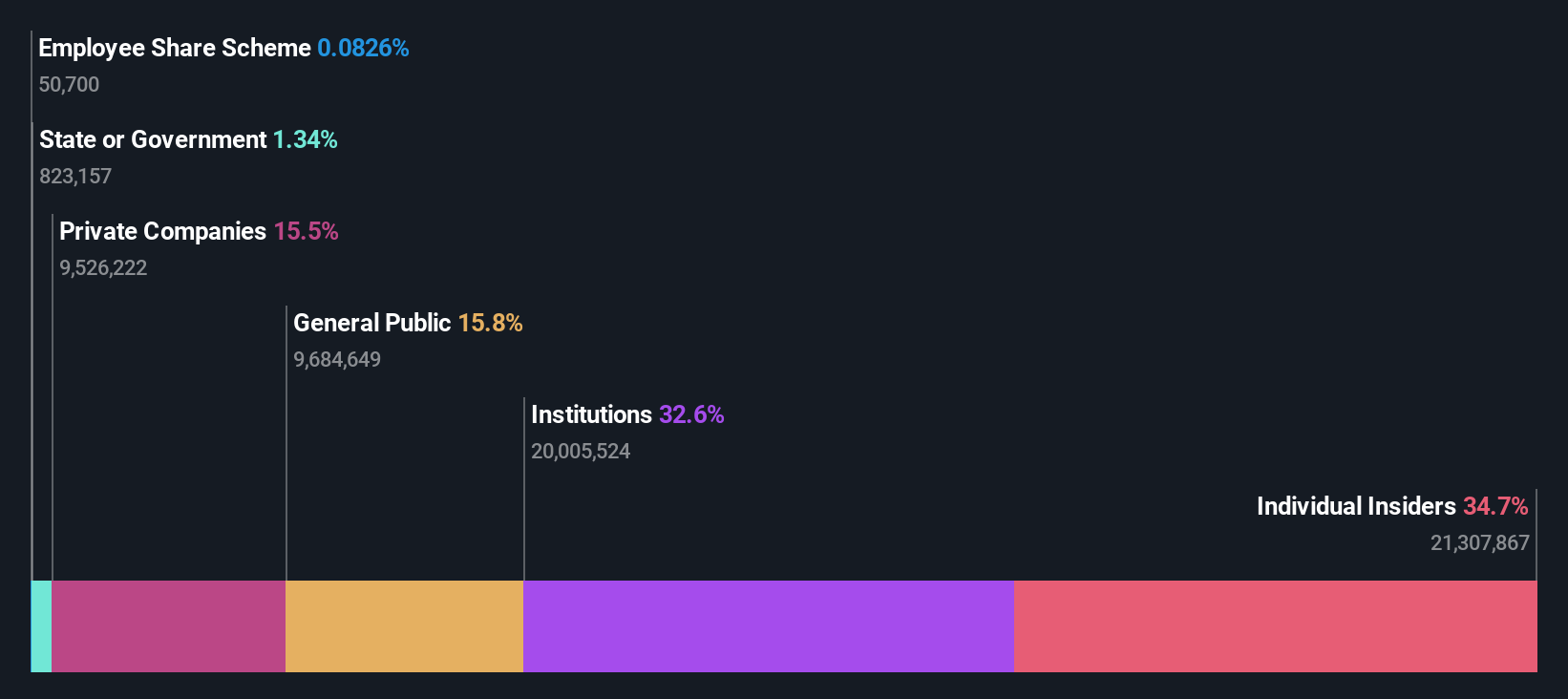

Mrs. Bectors Food Specialities (NSEI:BECTORFOOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mrs. Bectors Food Specialities Limited is an Indian company that manufactures and distributes a variety of food products, with a market capitalization of approximately ₹83.09 billion.

Operations: The company generates revenue primarily from the sale of food products, totaling approximately ₹16.24 billion.

Insider Ownership: 36.2%

Earnings Growth Forecast: 16.5% p.a.

Mrs. Bectors Food Specialities, a growth-oriented company with substantial insider ownership in India, is actively seeking to expand its financial base by raising up to INR 4 billion through various securities. This move underscores its robust growth trajectory, with earnings expected to grow at 16.5% annually, slightly outpacing the broader Indian market's forecast of 15.9%. Despite this promising outlook, revenue growth projections are moderate at 15% per year. The company has demonstrated significant profit growth over the past year and maintains high-quality earnings with a strong return on equity forecasted for the coming years.

- Click to explore a detailed breakdown of our findings in Mrs. Bectors Food Specialities' earnings growth report.

- According our valuation report, there's an indication that Mrs. Bectors Food Specialities' share price might be on the expensive side.

Turning Ideas Into Actions

- Gain an insight into the universe of 83 Fast Growing Indian Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARVINDFASN

Arvind Fashions

Engages in the wholesale and retail trading of garments and accessories in India and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives