- India

- /

- Real Estate

- /

- NSEI:KBCGLOBAL

Karda Constructions' (NSE:KARDA) Wonderful 353% Share Price Increase Shows How Capitalism Can Build Wealth

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, the Karda Constructions Limited (NSE:KARDA) share price rocketed moonwards 353% in just one year. It's also good to see the share price up 22% over the last quarter. But this could be related to the strong market, which is up 22% in the last three months. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for Karda Constructions

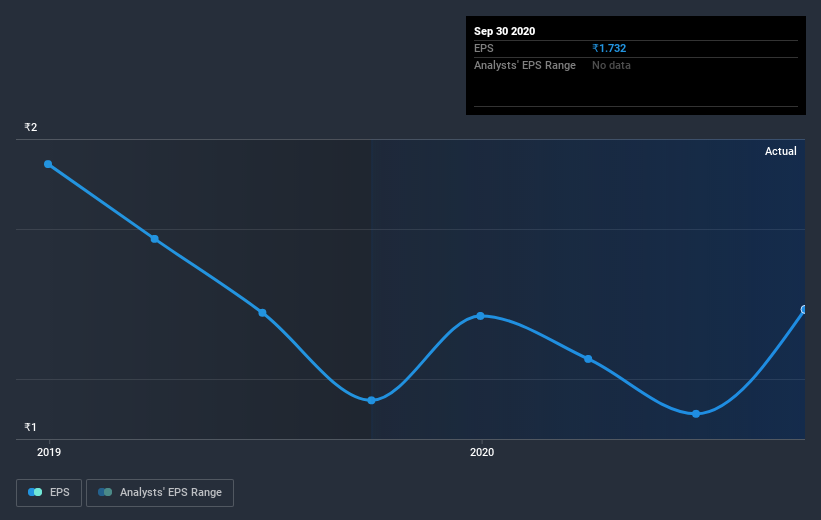

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Karda Constructions was able to grow EPS by 21% in the last twelve months. This EPS growth is significantly lower than the 353% increase in the share price. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 68.91 also points to this optimism.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Karda Constructions' earnings, revenue and cash flow.

A Different Perspective

Karda Constructions boasts a total shareholder return of 353% for the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 22%. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Karda Constructions you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Karda Constructions or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KBC Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KBCGLOBAL

KBC Global

Engages in the real estate construction, development, civil contracts, and other related activities in India.

Excellent balance sheet slight.