- India

- /

- Real Estate

- /

- NSEI:COUNCODOS

Should Weakness in Country Condo's Limited's (NSE:COUNCODOS) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

With its stock down 36% over the past month, it is easy to disregard Country Condo's (NSE:COUNCODOS). However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to Country Condo's' ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Country Condo's is:

2.2% = ₹5.6m ÷ ₹249m (Based on the trailing twelve months to December 2024).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every ₹1 worth of equity, the company was able to earn ₹0.02 in profit.

Check out our latest analysis for Country Condo's

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Country Condo's' Earnings Growth And 2.2% ROE

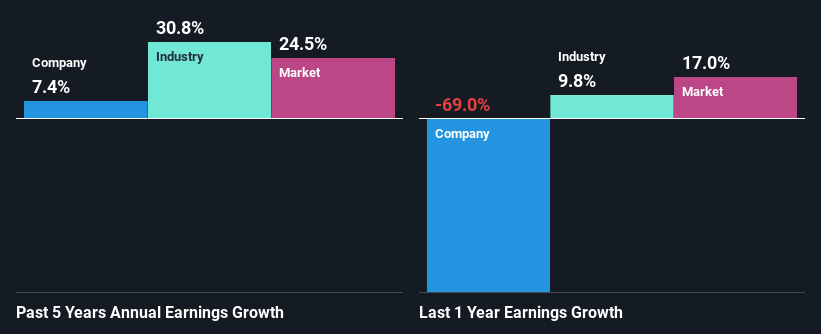

It is hard to argue that Country Condo's' ROE is much good in and of itself. Not just that, even compared to the industry average of 6.1%, the company's ROE is entirely unremarkable. Country Condo's was still able to see a decent net income growth of 7.4% over the past five years. We reckon that there could be other factors at play here. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Country Condo's' reported growth was lower than the industry growth of 31% over the last few years, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Country Condo's fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Country Condo's Making Efficient Use Of Its Profits?

Country Condo's doesn't pay any regular dividends, meaning that all of its profits are being reinvested in the business, which explains the fair bit of earnings growth the company has seen.

Conclusion

Overall, we feel that Country Condo's certainly does have some positive factors to consider. Namely, its respectable earnings growth, which it achieved due to it retaining most of its profits. However, given the low ROE, investors may not be benefitting from all that reinvestment after all. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 5 risks we have identified for Country Condo's.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:COUNCODOS

Excellent balance sheet with slight risk.

Market Insights

Community Narratives