- India

- /

- Real Estate

- /

- NSEI:AGIIL

Further Upside For AGI Infra Limited (NSE:AGIIL) Shares Could Introduce Price Risks After 51% Bounce

AGI Infra Limited (NSE:AGIIL) shares have continued their recent momentum with a 51% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

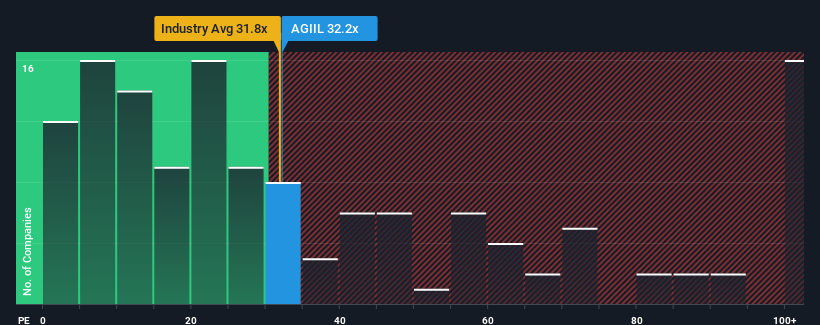

Even after such a large jump in price, it's still not a stretch to say that AGI Infra's price-to-earnings (or "P/E") ratio of 32.2x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 33x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Earnings have risen at a steady rate over the last year for AGI Infra, which is generally not a bad outcome. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for AGI Infra

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like AGI Infra's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.4% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 138% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that AGI Infra's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On AGI Infra's P/E

AGI Infra appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that AGI Infra currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 1 warning sign for AGI Infra that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AGIIL

AGI Infra

Agi Infra Limited, together with its subsidiary, engages in the real estate and construction businesses in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives