Stock Analysis

- New Zealand

- /

- Healthcare Services

- /

- NZSE:RYM

NRW Holdings And 2 Other Top Undervalued Small Caps With Insider Actions In The Region

Reviewed by Simply Wall St

In recent weeks, global markets have displayed a notable shift towards small-cap and value shares, with the Russell 2000 Index reflecting a positive trajectory. This trend underscores an environment where discerning investors might find significant opportunities among undervalued small caps, such as NRW Holdings, which are poised to potentially benefit from current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.8x | 3.0x | 46.00% | ★★★★★★ |

| Calfrac Well Services | 2.3x | 0.2x | 27.77% | ★★★★★☆ |

| Nexus Industrial REIT | 2.8x | 3.4x | 13.89% | ★★★★☆☆ |

| Columbus McKinnon | 22.9x | 1.1x | 45.55% | ★★★★☆☆ |

| Guardian Capital Group | 10.4x | 4.0x | 31.08% | ★★★★☆☆ |

| Papa John's International | 17.9x | 0.6x | 41.13% | ★★★★☆☆ |

| Chatham Lodging Trust | NA | 1.4x | 14.67% | ★★★★☆☆ |

| Hemisphere Energy | 7.0x | 2.5x | 0.18% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -124.21% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

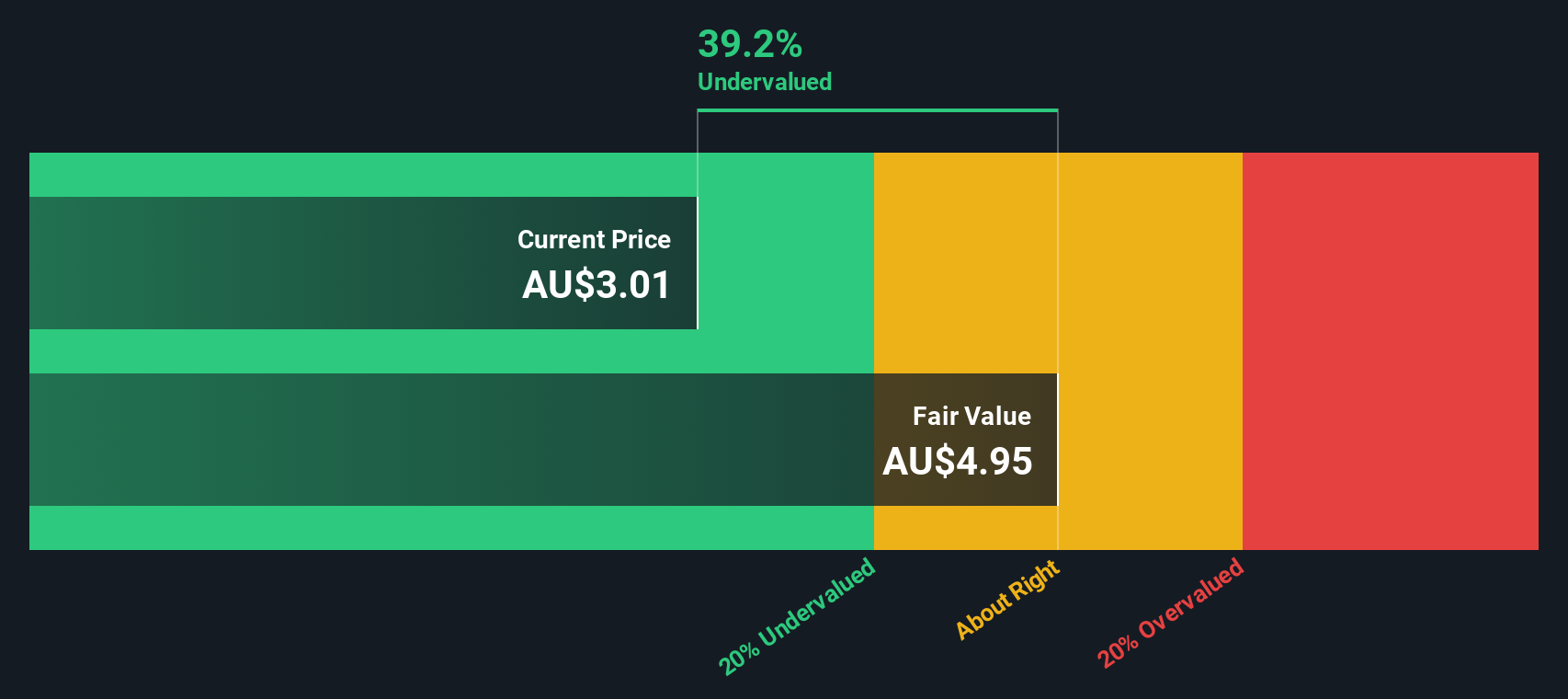

NRW Holdings (ASX:NWH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NRW Holdings is an Australian company engaged in civil and mining services, with operations spanning across multiple sectors including MET, Civil, and Mining.

Operations: The company generates revenue primarily from three segments: MET, Civil, and Mining, contributing A$739.07 million, A$593.62 million, and A$1.49 billion respectively. Over recent periods, the gross profit margin has shown a trend of fluctuation but maintains an average around 46% to 47%.

PE: 17.3x

NRW Holdings, a notable player in the small-cap sector, recently reaffirmed its fiscal 2024 revenue forecast at A$2.9 billion, underscoring stability in its financial outlook. With earnings expected to grow by 13.33% annually, investor confidence is further bolstered by insider activities; insiders have recently purchased shares, signaling strong belief in the company's prospects despite relying solely on external borrowing—a higher risk funding strategy. Moreover, the successful completion of a A$5.26 million equity offering on July 11 enhances their capital structure and supports ongoing growth initiatives.

- Delve into the full analysis valuation report here for a deeper understanding of NRW Holdings.

Evaluate NRW Holdings' historical performance by accessing our past performance report.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company with operations primarily in the manufacturing and marketing of formulation products, boasting a market capitalization of approximately ₹21.77 billion.

Operations: The pharmaceuticals segment generated a revenue of ₹21.77 billion, with a gross profit margin of 52.32% in the most recent period reported. This reflects an increase in gross profit from previous periods, highlighting improved efficiency or pricing strategies despite rising operational costs.

PE: 29.0x

Marksans Pharma recently showcased a solid financial trajectory, with a notable year-over-year increase in sales and revenue for the fiscal year ending March 2024. Despite slightly lower net income in the fourth quarter, annual figures reflect robust growth. Insider confidence is evident from recent share purchases, signaling optimism about future prospects. Additionally, the company's decision to increase dividends underscores its commitment to shareholder returns amidst forecasts of a 21.63% annual earnings growth.

- Click here to discover the nuances of Marksans Pharma with our detailed analytical valuation report.

Review our historical performance report to gain insights into Marksans Pharma's's past performance.

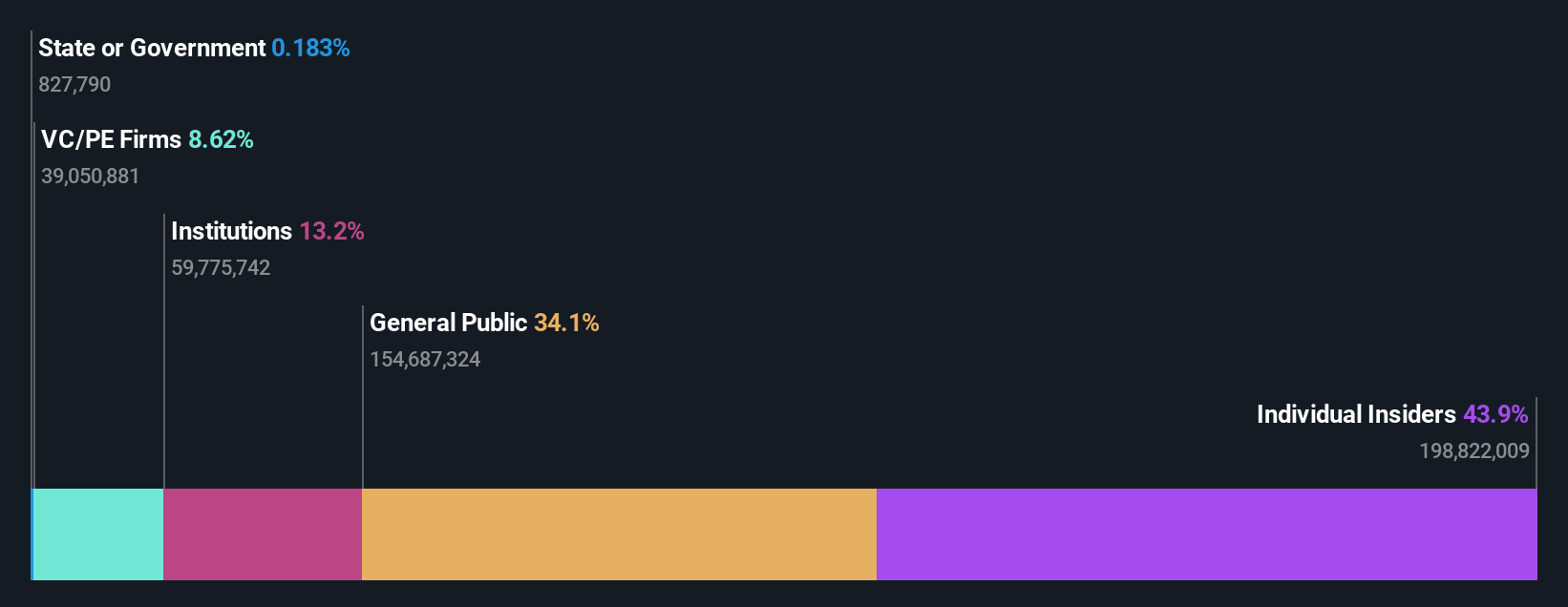

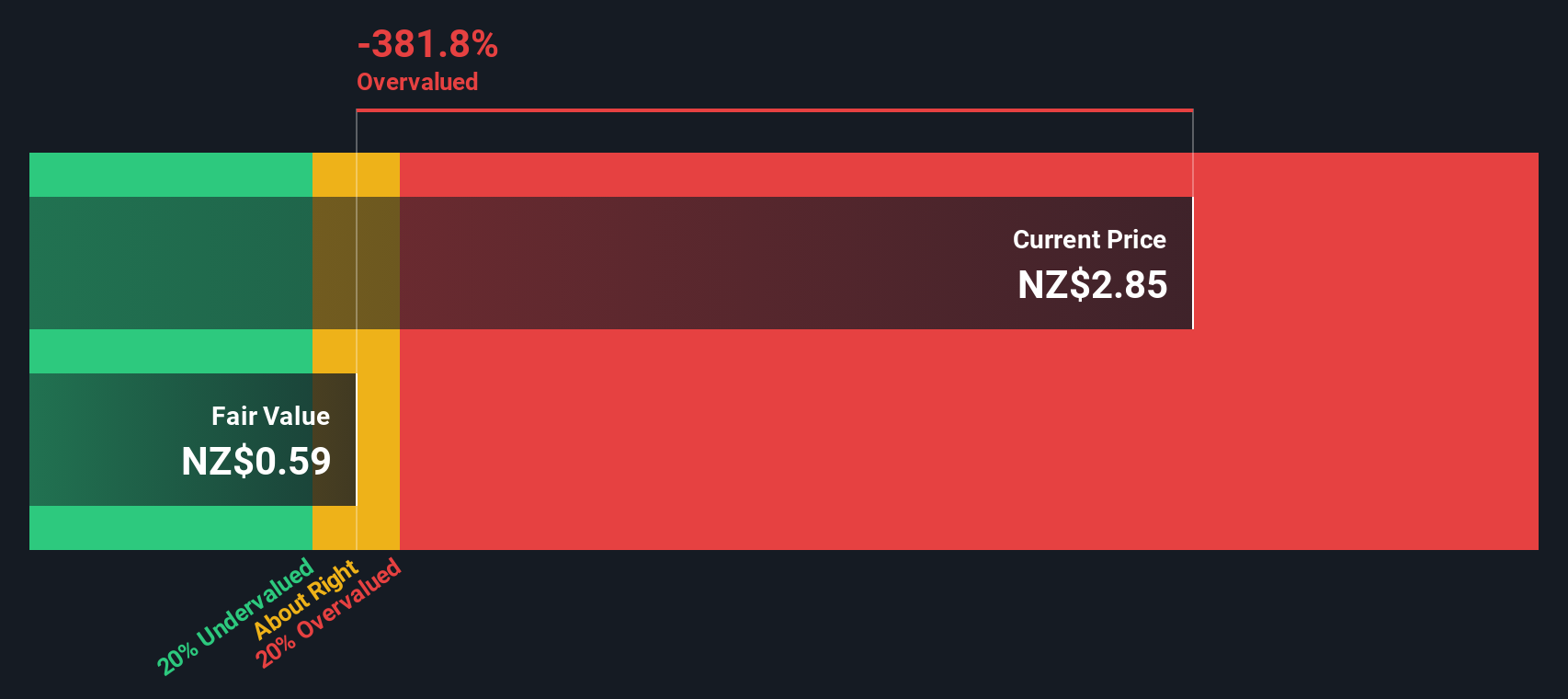

Ryman Healthcare (NZSE:RYM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ryman Healthcare operates integrated retirement villages for older people, with a business model focused on providing comprehensive living and care options.

Operations: The integrated retirement villages segment generated NZ$687.56 million, with a notable gross profit margin of 5.19% in the most recent financial period. This performance reflects the company's focus on providing specialized living solutions for older adults, although it has seen a fluctuation in net income margins over recent periods.

PE: 637.1x

Despite a challenging financial year ending March 2024, where Ryman Healthcare reported a significant drop in net income to NZ$4.78 million from NZ$257.84 million, the company is poised for recovery with earnings expected to grow by 22.19% annually. Recent insider confidence was demonstrated as they recently purchased shares, signaling belief in the firm's potential rebound. Additionally, Ryman is transitioning auditors to PwC, aiming to enhance governance and oversight after a long tenure with Deloitte. This move could reassure stakeholders about the company’s commitment to robust financial practices amidst its current undervalued status and high debt levels.

- Unlock comprehensive insights into our analysis of Ryman Healthcare stock in this valuation report.

Examine Ryman Healthcare's past performance report to understand how it has performed in the past.

Key Takeaways

- Click this link to deep-dive into the 223 companies within our Undervalued Small Caps With Insider Buying screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:RYM

Ryman Healthcare

Develops, owns, and operates integrated retirement villages, rest homes, and hospitals for the elderly people in New Zealand and Australia.

Reasonable growth potential and fair value.