Here's Why Beta Drugs Limited's (NSE:BETA) CEO May Deserve A Raise

Key Insights

- Beta Drugs will host its Annual General Meeting on 30th of September

- Salary of ₹15.1m is part of CEO Rahul Batra's total remuneration

- The total compensation is 50% less than the average for the industry

- Over the past three years, Beta Drugs' EPS grew by 20% and over the past three years, the total shareholder return was 154%

The solid performance at Beta Drugs Limited (NSE:BETA) has been impressive and shareholders will probably be pleased to know that CEO Rahul Batra has delivered. At the upcoming AGM on 30th of September, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

Check out our latest analysis for Beta Drugs

How Does Total Compensation For Rahul Batra Compare With Other Companies In The Industry?

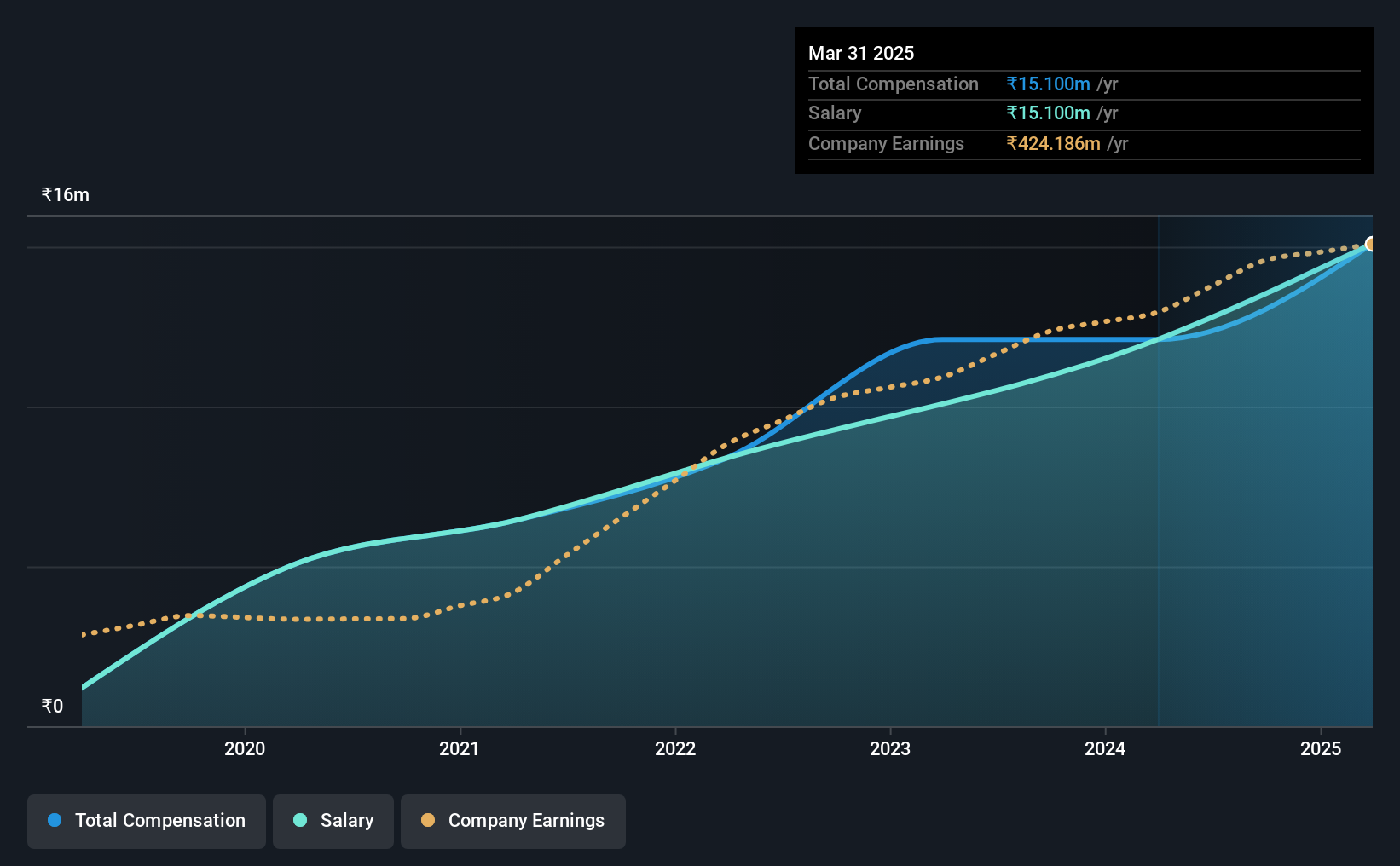

Our data indicates that Beta Drugs Limited has a market capitalization of ₹18b, and total annual CEO compensation was reported as ₹15m for the year to March 2025. That's a notable increase of 25% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹15m.

On examining similar-sized companies in the Indian Pharmaceuticals industry with market capitalizations between ₹8.9b and ₹35b, we discovered that the median CEO total compensation of that group was ₹30m. Accordingly, Beta Drugs pays its CEO under the industry median. Moreover, Rahul Batra also holds ₹76m worth of Beta Drugs stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹15m | ₹12m | 100% |

| Other | - | - | - |

| Total Compensation | ₹15m | ₹12m | 100% |

On an industry level, roughly 99% of total compensation represents salary and 0.79361173% is other remuneration. On a company level, Beta Drugs prefers to reward its CEO through a salary, opting not to pay Rahul Batra through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Beta Drugs Limited's Growth

Beta Drugs Limited's earnings per share (EPS) grew 20% per year over the last three years. In the last year, its revenue is up 23%.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Beta Drugs Limited Been A Good Investment?

Boasting a total shareholder return of 154% over three years, Beta Drugs Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Beta Drugs rewards its CEO solely through a salary, ignoring non-salary benefits completely. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Beta Drugs that investors should be aware of in a dynamic business environment.

Important note: Beta Drugs is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Beta Drugs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BETA

Beta Drugs

Develops, manufactures, and sells anti-cancer bulk drugs and finished dosages in India.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives