Here's Why Shareholders May Want To Be Cautious With Increasing Aurobindo Pharma Limited's (NSE:AUROPHARMA) CEO Pay Packet

CEO Narayanan Govindarajan has done a decent job of delivering relatively good performance at Aurobindo Pharma Limited (NSE:AUROPHARMA) recently. As shareholders go into the upcoming AGM on 26 August 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Aurobindo Pharma

Comparing Aurobindo Pharma Limited's CEO Compensation With the industry

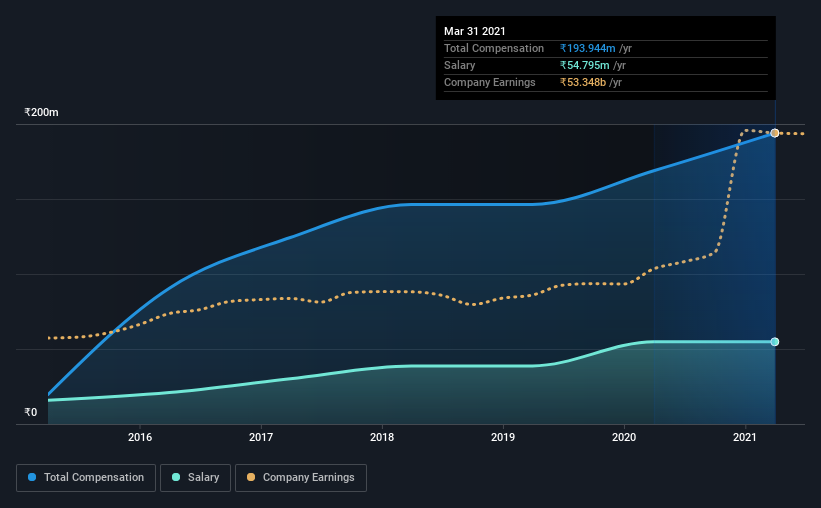

At the time of writing, our data shows that Aurobindo Pharma Limited has a market capitalization of ₹423b, and reported total annual CEO compensation of ₹194m for the year to March 2021. We note that's an increase of 15% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at ₹55m.

For comparison, other companies in the same industry with market capitalizations ranging between ₹297b and ₹891b had a median total CEO compensation of ₹128m. Hence, we can conclude that Narayanan Govindarajan is remunerated higher than the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹55m | ₹55m | 28% |

| Other | ₹139m | ₹114m | 72% |

| Total Compensation | ₹194m | ₹169m | 100% |

Speaking on an industry level, nearly 97% of total compensation represents salary, while the remainder of 3% is other remuneration. In Aurobindo Pharma's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Aurobindo Pharma Limited's Growth Numbers

Over the past three years, Aurobindo Pharma Limited has seen its earnings per share (EPS) grow by 31% per year. It achieved revenue growth of 4.1% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Aurobindo Pharma Limited Been A Good Investment?

Aurobindo Pharma Limited has not done too badly by shareholders, with a total return of 7.2%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 4 warning signs for Aurobindo Pharma that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Aurobindo Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AUROPHARMA

Aurobindo Pharma

A biopharmaceutical company, develops, manufactures, commercializes, and sells generic pharmaceuticals, active pharmaceutical ingredients (APIs), and injectables.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success