- India

- /

- Entertainment

- /

- NSEI:TIPSMUSIC

Tips Music Limited's (NSE:TIPSMUSIC) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

Most readers would already be aware that Tips Music's (NSE:TIPSMUSIC) stock increased significantly by 7.4% over the past week. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Particularly, we will be paying attention to Tips Music's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Tips Music is:

68% = ₹1.7b ÷ ₹2.6b (Based on the trailing twelve months to September 2025).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every ₹1 worth of equity, the company was able to earn ₹0.68 in profit.

View our latest analysis for Tips Music

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Tips Music's Earnings Growth And 68% ROE

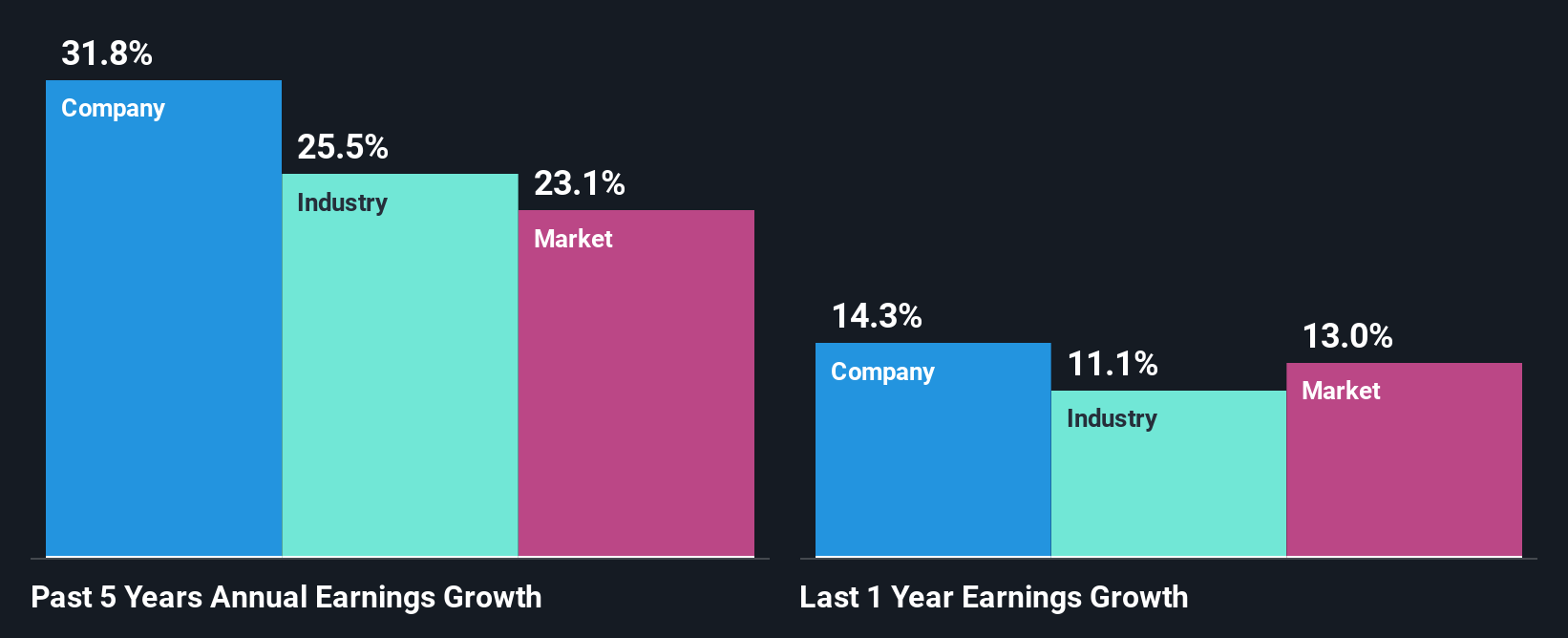

To begin with, Tips Music has a pretty high ROE which is interesting. Secondly, even when compared to the industry average of 6.4% the company's ROE is quite impressive. So, the substantial 32% net income growth seen by Tips Music over the past five years isn't overly surprising.

We then compared Tips Music's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 26% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Tips Music is trading on a high P/E or a low P/E, relative to its industry.

Is Tips Music Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 59% (implying that it keeps only 41% of profits) for Tips Music suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Besides, Tips Music has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 66%. Still, forecasts suggest that Tips Music's future ROE will rise to 94% even though the the company's payout ratio is not expected to change by much.

Conclusion

Overall, we are quite pleased with Tips Music's performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Tips Music might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIPSMUSIC

Tips Music

Engages in the acquisition and exploitation of music rights in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success