Does Raj Television Network (NSE:RAJTV) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Raj Television Network Limited (NSE:RAJTV) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Raj Television Network

How Much Debt Does Raj Television Network Carry?

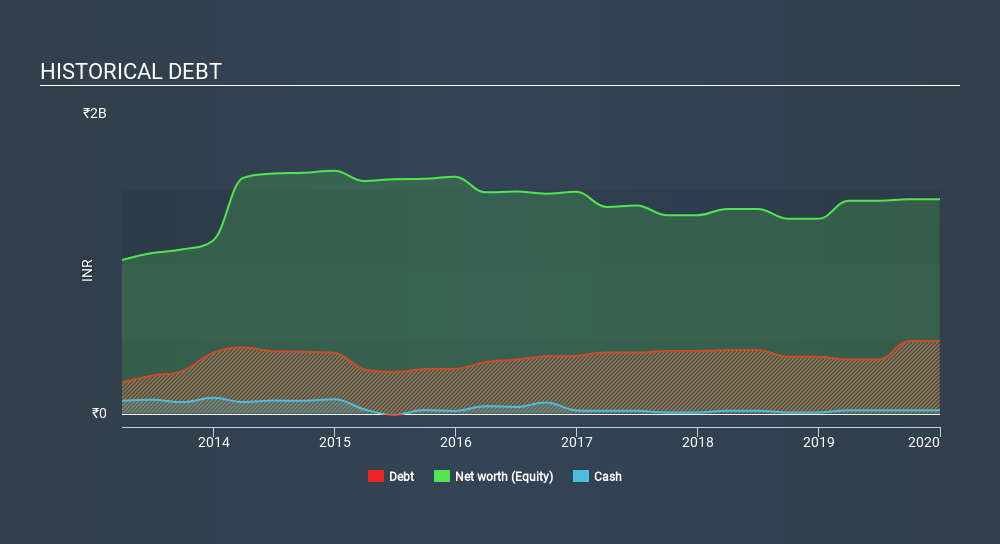

As you can see below, at the end of September 2019, Raj Television Network had ₹485.2m of debt, up from ₹378.8m a year ago. Click the image for more detail. However, it also had ₹21.7m in cash, and so its net debt is ₹463.5m.

How Strong Is Raj Television Network's Balance Sheet?

We can see from the most recent balance sheet that Raj Television Network had liabilities of ₹287.0m falling due within a year, and liabilities of ₹304.1m due beyond that. Offsetting these obligations, it had cash of ₹21.7m as well as receivables valued at ₹654.8m due within 12 months. So it can boast ₹85.3m more liquid assets than total liabilities.

This surplus suggests that Raj Television Network has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Raj Television Network's net debt is sitting at a very reasonable 2.5 times its EBITDA, while its EBIT covered its interest expense just 3.0 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Notably, Raj Television Network's EBIT launched higher than Elon Musk, gaining a whopping 130% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Raj Television Network's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent two years, Raj Television Network recorded free cash flow worth 62% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Raj Television Network's impressive EBIT growth rate implies it has the upper hand on its debt. But we must concede we find its interest cover has the opposite effect. When we consider the range of factors above, it looks like Raj Television Network is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Raj Television Network that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:RAJTV

Raj Television Network

Operates as a television satellite broadcaster in India.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives