Investors Still Aren't Entirely Convinced By MPS Limited's (NSE:MPSLTD) Earnings Despite 26% Price Jump

MPS Limited (NSE:MPSLTD) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 74%.

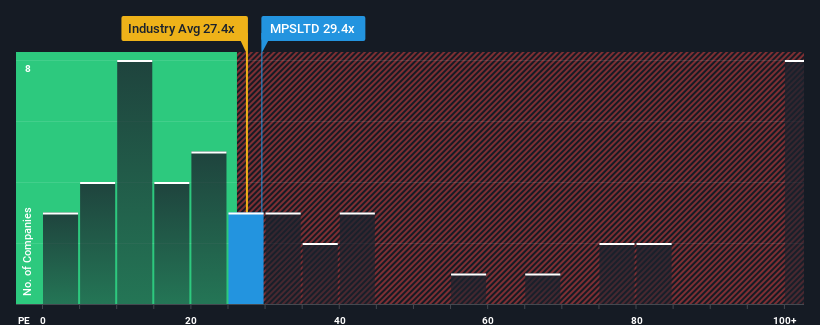

Even after such a large jump in price, you could still be forgiven for feeling indifferent about MPS' P/E ratio of 29.4x, since the median price-to-earnings (or "P/E") ratio in India is also close to 31x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for MPS as its earnings have been rising slower than most other companies. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for MPS

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like MPS' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.6% last year. The latest three year period has also seen an excellent 119% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 31% during the coming year according to the sole analyst following the company. With the market only predicted to deliver 25%, the company is positioned for a stronger earnings result.

In light of this, it's curious that MPS' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On MPS' P/E

MPS' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of MPS' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with MPS.

If you're unsure about the strength of MPS' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MPSLTD

MPS

Provides platforms and services for content creation, full-service production, and distribution to the publishers, learning companies, corporate institutions, libraries, and content aggregators in India, Europe, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives