- India

- /

- Interactive Media and Services

- /

- NSEI:JUSTDIAL

There's No Escaping Just Dial Limited's (NSE:JUSTDIAL) Muted Earnings Despite A 38% Share Price Rise

Just Dial Limited (NSE:JUSTDIAL) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 61% in the last year.

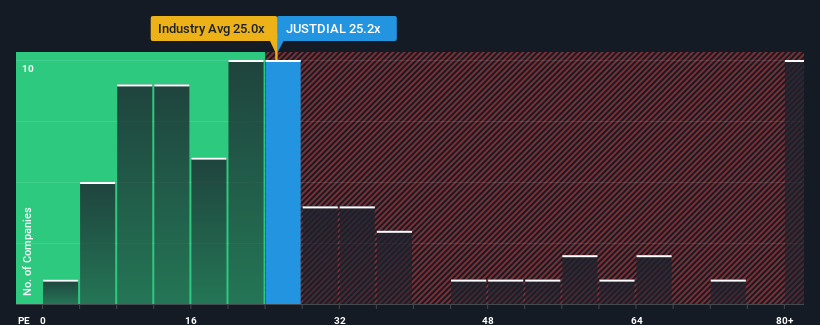

Even after such a large jump in price, Just Dial may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 25.2x, since almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 60x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Just Dial as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Just Dial

How Is Just Dial's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Just Dial's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 121% gain to the company's bottom line. The latest three year period has also seen a 26% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 14% each year during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 20% per year growth forecast for the broader market.

With this information, we can see why Just Dial is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Just Dial's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Just Dial maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Just Dial with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JUSTDIAL

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives