- India

- /

- Interactive Media and Services

- /

- NSEI:JUSTDIAL

Benign Growth For Just Dial Limited (NSE:JUSTDIAL) Underpins Its Share Price

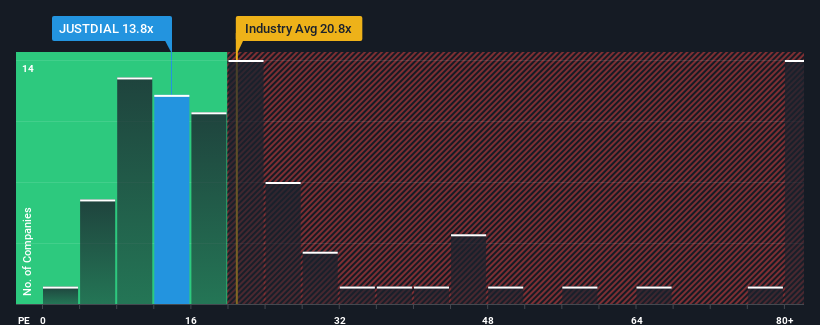

Just Dial Limited's (NSE:JUSTDIAL) price-to-earnings (or "P/E") ratio of 13.8x might make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 26x and even P/E's above 49x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We've discovered 1 warning sign about Just Dial. View them for free.Just Dial certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Just Dial

Is There Any Growth For Just Dial?

In order to justify its P/E ratio, Just Dial would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 63%. The latest three year period has also seen an excellent 436% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings growth is heading into negative territory, declining 0.5% over the next year. That's not great when the rest of the market is expected to grow by 25%.

In light of this, it's understandable that Just Dial's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Just Dial's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Just Dial's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Just Dial that we have uncovered.

If these risks are making you reconsider your opinion on Just Dial, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JUSTDIAL

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives