Entertainment Network (India) Limited's (NSE:ENIL) 48% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Entertainment Network (India) Limited (NSE:ENIL) shares have been powering on, with a gain of 48% in the last thirty days. The last month tops off a massive increase of 158% in the last year.

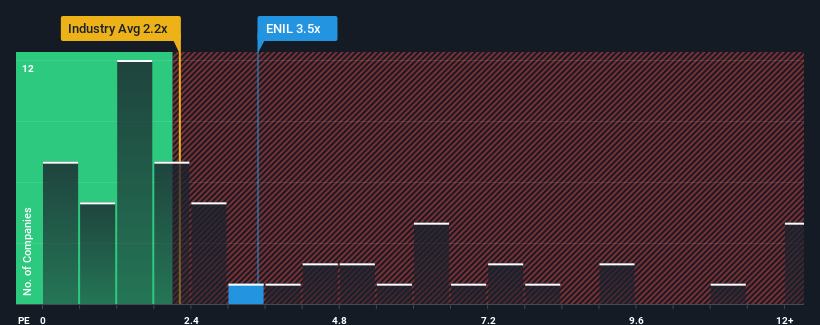

Following the firm bounce in price, given close to half the companies operating in India's Media industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Entertainment Network (India) as a stock to potentially avoid with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Entertainment Network (India)

What Does Entertainment Network (India)'s P/S Mean For Shareholders?

The recent revenue growth at Entertainment Network (India) would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Entertainment Network (India) will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Entertainment Network (India)?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Entertainment Network (India)'s to be considered reasonable.

Retrospectively, the last year delivered a decent 5.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 12% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Entertainment Network (India) is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

Entertainment Network (India) shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Entertainment Network (India) revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for Entertainment Network (India) (2 don't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Entertainment Network (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ENIL

Entertainment Network (India)

Together with its subsidiary, operates FM radio broadcasting stations in India and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success