- India

- /

- Interactive Media and Services

- /

- NSEI:DGCONTENT

Digicontent Limited (NSE:DGCONTENT) Stock Rockets 25% But Many Are Still Ignoring The Company

Despite an already strong run, Digicontent Limited (NSE:DGCONTENT) shares have been powering on, with a gain of 25% in the last thirty days. The last month tops off a massive increase of 142% in the last year.

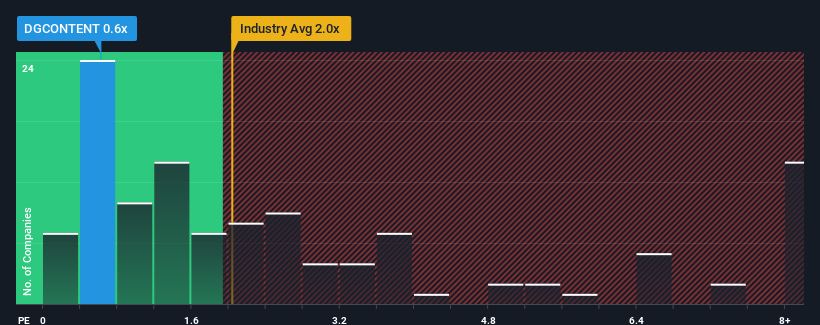

Even after such a large jump in price, when close to half the companies operating in India's Interactive Media and Services industry have price-to-sales ratios (or "P/S") above 2x, you may still consider Digicontent as an enticing stock to check out with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Digicontent

What Does Digicontent's P/S Mean For Shareholders?

Digicontent has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Digicontent, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Digicontent's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Digicontent's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The latest three year period has also seen an excellent 52% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 9.6%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that Digicontent is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Despite Digicontent's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Digicontent revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Digicontent (1 is concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DGCONTENT

Digicontent

Operates in the entertainment and digital innovation business in India.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives