Here's Why Worth Peripherals (NSE:WORTH) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Worth Peripherals Limited (NSE:WORTH) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Worth Peripherals

What Is Worth Peripherals's Net Debt?

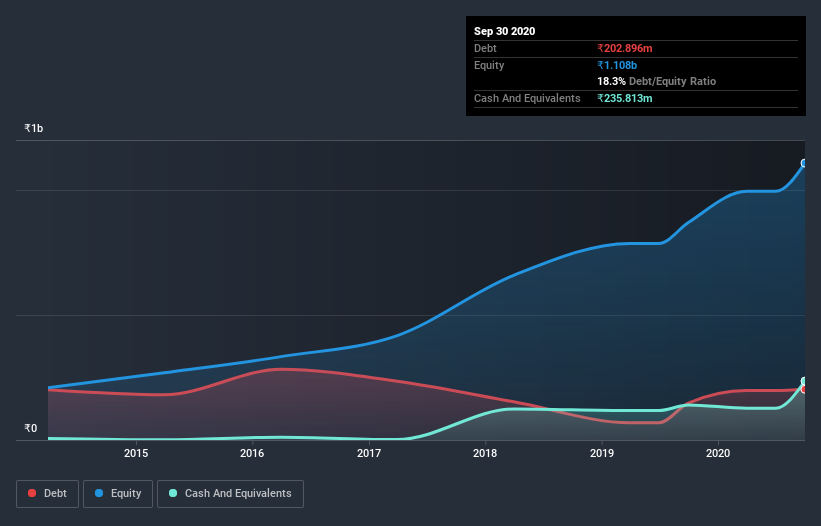

As you can see below, at the end of September 2020, Worth Peripherals had ₹202.9m of debt, up from ₹147.7m a year ago. Click the image for more detail. However, its balance sheet shows it holds ₹235.8m in cash, so it actually has ₹32.9m net cash.

How Healthy Is Worth Peripherals' Balance Sheet?

According to the last reported balance sheet, Worth Peripherals had liabilities of ₹162.6m due within 12 months, and liabilities of ₹269.9m due beyond 12 months. Offsetting these obligations, it had cash of ₹235.8m as well as receivables valued at ₹327.1m due within 12 months. So it actually has ₹130.4m more liquid assets than total liabilities.

This short term liquidity is a sign that Worth Peripherals could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Worth Peripherals boasts net cash, so it's fair to say it does not have a heavy debt load!

Also good is that Worth Peripherals grew its EBIT at 20% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Worth Peripherals's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Worth Peripherals may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Worth Peripherals created free cash flow amounting to 4.0% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Worth Peripherals has net cash of ₹32.9m, as well as more liquid assets than liabilities. And it impressed us with its EBIT growth of 20% over the last year. So we are not troubled with Worth Peripherals's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Worth Peripherals you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Worth Peripherals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Worth Peripherals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:WORTHPERI

Worth Peripherals

Manufactures and sells corrugated boxes and sheets in India.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives