- India

- /

- Paper and Forestry Products

- /

- NSEI:TNPL

Here's What's Concerning About Tamil Nadu Newsprint and Papers (NSE:TNPL)

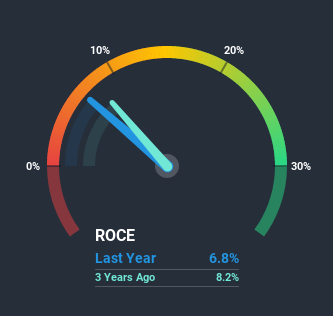

What underlying fundamental trends can indicate that a company might be in decline? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. And from a first read, things don't look too good at Tamil Nadu Newsprint and Papers (NSE:TNPL), so let's see why.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Tamil Nadu Newsprint and Papers:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.068 = ₹2.1b ÷ (₹58b - ₹27b) (Based on the trailing twelve months to September 2020).

Therefore, Tamil Nadu Newsprint and Papers has an ROCE of 6.8%. On its own, that's a low figure but it's around the 7.7% average generated by the Forestry industry.

See our latest analysis for Tamil Nadu Newsprint and Papers

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Tamil Nadu Newsprint and Papers has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From Tamil Nadu Newsprint and Papers' ROCE Trend?

We are a bit worried about the trend of returns on capital at Tamil Nadu Newsprint and Papers. Unfortunately the returns on capital have diminished from the 12% that they were earning five years ago. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect Tamil Nadu Newsprint and Papers to turn into a multi-bagger.

On a side note, Tamil Nadu Newsprint and Papers' current liabilities have increased over the last five years to 47% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

The Bottom Line

In summary, it's unfortunate that Tamil Nadu Newsprint and Papers is generating lower returns from the same amount of capital. Investors haven't taken kindly to these developments, since the stock has declined 33% from where it was five years ago. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you'd like to know more about Tamil Nadu Newsprint and Papers, we've spotted 5 warning signs, and 2 of them shouldn't be ignored.

While Tamil Nadu Newsprint and Papers may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Tamil Nadu Newsprint and Papers or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tamil Nadu Newsprint and Papers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TNPL

Tamil Nadu Newsprint and Papers

Manufactures and markets paper and paperboards in India and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives