- India

- /

- Metals and Mining

- /

- NSEI:TIRUPATIFL

Even With A 28% Surge, Cautious Investors Are Not Rewarding Tirupati Forge Limited's (NSE:TIRUPATIFL) Performance Completely

Tirupati Forge Limited (NSE:TIRUPATIFL) shares have continued their recent momentum with a 28% gain in the last month alone. The annual gain comes to 183% following the latest surge, making investors sit up and take notice.

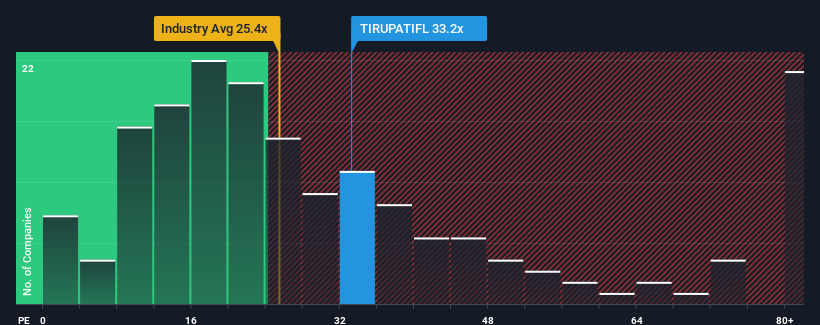

Although its price has surged higher, it's still not a stretch to say that Tirupati Forge's price-to-earnings (or "P/E") ratio of 33.2x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 32x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Tirupati Forge over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Tirupati Forge

How Is Tirupati Forge's Growth Trending?

Tirupati Forge's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 30%. Still, the latest three year period has seen an excellent 1,568% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Tirupati Forge is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Tirupati Forge's P/E?

Tirupati Forge appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Tirupati Forge currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Tirupati Forge (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tirupati Forge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TIRUPATIFL

Tirupati Forge

Produces and sells carbon steel forged flanges, forged, and other automotive components in India.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives