Stock Analysis

Time Technoplast (NSE:TIMETECHNO) Share Prices Have Dropped 78% In The Last Three Years

Time Technoplast Limited (NSE:TIMETECHNO) shareholders should be happy to see the share price up 26% in the last quarter. But only the myopic could ignore the astounding decline over three years. Indeed, the share price is down a whopping 78% in the last three years. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

View our latest analysis for Time Technoplast

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

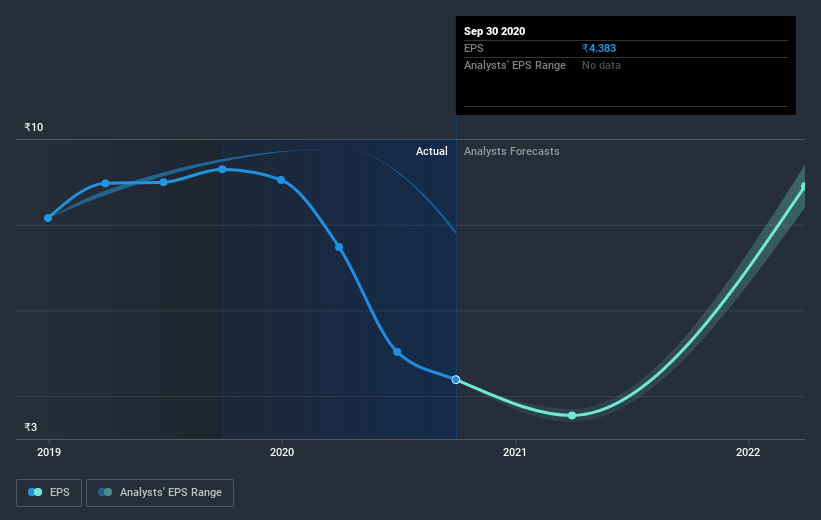

Time Technoplast saw its EPS decline at a compound rate of 15% per year, over the last three years. The share price decline of 39% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 10.95.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market gained around 17% in the last year, Time Technoplast shareholders lost 8.3% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Time Technoplast better, we need to consider many other factors. For instance, we've identified 3 warning signs for Time Technoplast (1 is concerning) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Time Technoplast, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Time Technoplast is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TIMETECHNO

Time Technoplast

Engages in manufacture and sale of a range of technology-based polymer and composite products in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.