- India

- /

- Metals and Mining

- /

- NSEI:SURYAROSNI

Does Surya Roshni (NSE:SURYAROSNI) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Surya Roshni (NSE:SURYAROSNI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Surya Roshni

How Quickly Is Surya Roshni Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, Surya Roshni has grown EPS by 20% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

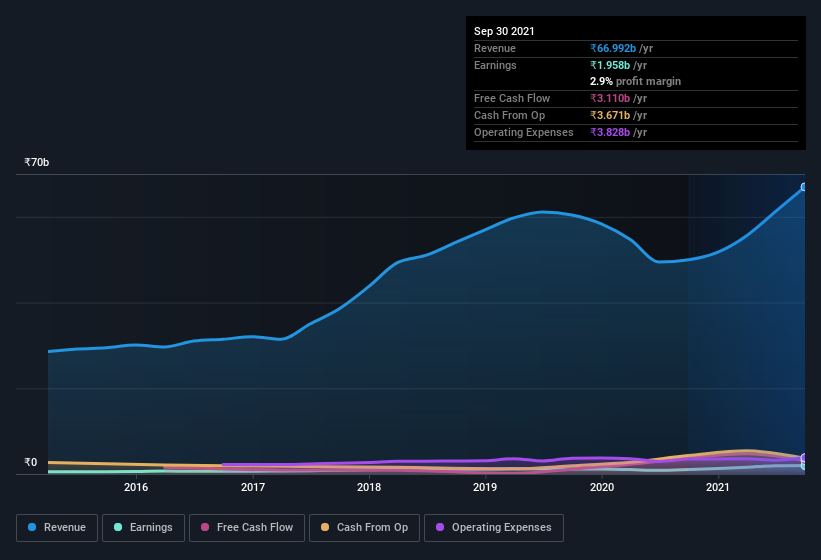

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Surya Roshni's EBIT margins were flat over the last year, revenue grew by a solid 34% to ₹67b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Surya Roshni Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Surya Roshni top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the ₹4.0m that Additional Whole-Time Director Vinay Surya spent buying shares (at an average price of about ₹276).

Along with the insider buying, another encouraging sign for Surya Roshni is that insiders, as a group, have a considerable shareholding. To be specific, they have ₹3.1b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 9.6% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Surya Roshni To Your Watchlist?

For growth investors like me, Surya Roshni's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. Even so, be aware that Surya Roshni is showing 3 warning signs in our investment analysis , you should know about...

As a growth investor I do like to see insider buying. But Surya Roshni isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SURYAROSNI

Surya Roshni

Manufactures and sells steel pipes and strips, and lighting and consumer durables in India.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives