Shree Rama Multi-Tech Limited (NSE:SHREERAMA) Delivered A Better ROE Than Its Industry

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. To keep the lesson grounded in practicality, we'll use ROE to better understand Shree Rama Multi-Tech Limited (NSE:SHREERAMA).

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Shree Rama Multi-Tech

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shree Rama Multi-Tech is:

79% = ₹194m ÷ ₹246m (Based on the trailing twelve months to June 2020).

The 'return' is the profit over the last twelve months. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.79.

Does Shree Rama Multi-Tech Have A Good Return On Equity?

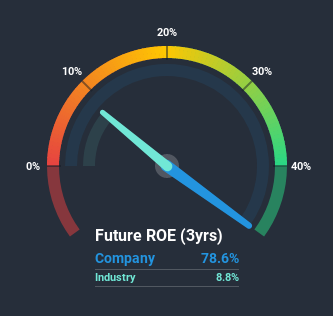

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. Pleasingly, Shree Rama Multi-Tech has a superior ROE than the average (8.8%) in the Packaging industry.

That's clearly a positive. With that said, a high ROE doesn't always indicate high profitability. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. Our risks dashboardshould have the 4 risks we have identified for Shree Rama Multi-Tech.

How Does Debt Impact Return On Equity?

Most companies need money -- from somewhere -- to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. That will make the ROE look better than if no debt was used.

Combining Shree Rama Multi-Tech's Debt And Its 79% Return On Equity

It seems that Shree Rama Multi-Tech uses a huge volume of debt to fund the business, since it has an extremely high debt to equity ratio of 3.19. Its ROE is clearly quite good, but it seems to be boosted by the significant use of debt by the company.

Conclusion

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have the same ROE, then I would generally prefer the one with less debt.

But when a business is high quality, the market often bids it up to a price that reflects this. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. Check the past profit growth by Shree Rama Multi-Tech by looking at this visualization of past earnings, revenue and cash flow.

Of course Shree Rama Multi-Tech may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

If you decide to trade Shree Rama Multi-Tech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SHREERAMA

Shree Rama Multi-Tech

Manufactures and sells packaging products in India, Europe, Asia, Africa, North America, South West America., and Russia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives