- India

- /

- Metals and Mining

- /

- NSEI:RKFORGE

Optimistic Investors Push Ramkrishna Forgings Limited (NSE:RKFORGE) Shares Up 26% But Growth Is Lacking

Despite an already strong run, Ramkrishna Forgings Limited (NSE:RKFORGE) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 109% in the last year.

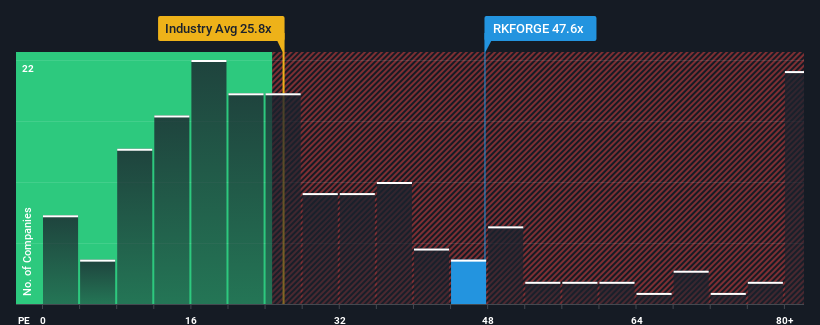

After such a large jump in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 32x, you may consider Ramkrishna Forgings as a stock to potentially avoid with its 47.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's superior to most other companies of late, Ramkrishna Forgings has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Ramkrishna Forgings

Is There Enough Growth For Ramkrishna Forgings?

In order to justify its P/E ratio, Ramkrishna Forgings would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. The latest three year period has also seen an excellent 1,366% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 25% as estimated by the six analysts watching the company. With the market predicted to deliver 25% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that Ramkrishna Forgings' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Ramkrishna Forgings' P/E

Ramkrishna Forgings shares have received a push in the right direction, but its P/E is elevated too. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Ramkrishna Forgings' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Ramkrishna Forgings you should know about.

If you're unsure about the strength of Ramkrishna Forgings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RKFORGE

Ramkrishna Forgings

Engages in the manufacture and sale of forged components for automobiles, railway wagons and coaches, and engineering parts in India and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives