- India

- /

- Metals and Mining

- /

- NSEI:ORIENTCER

Potential Upside For Orient Abrasives Limited (NSE:ORIENTABRA) Not Without Risk

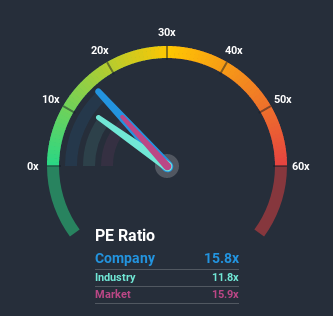

With a median price-to-earnings (or "P/E") ratio of close to 16x in India, you could be forgiven for feeling indifferent about Orient Abrasives Limited's (NSE:ORIENTABRA) P/E ratio of 15.8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For example, consider that Orient Abrasives' financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Orient Abrasives

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Orient Abrasives' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 5.5% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 161% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 10% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's curious that Orient Abrasives' P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Orient Abrasives' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Orient Abrasives revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Orient Abrasives that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

When trading Orient Abrasives or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ORIENTCER

Orient Ceratech

Engages in the producing and trading of aluminum refractories and monolithic products in India.

Excellent balance sheet second-rate dividend payer.