- India

- /

- Basic Materials

- /

- NSEI:NUVOCO

Investors Continue Waiting On Sidelines For Nuvoco Vistas Corporation Limited (NSE:NUVOCO)

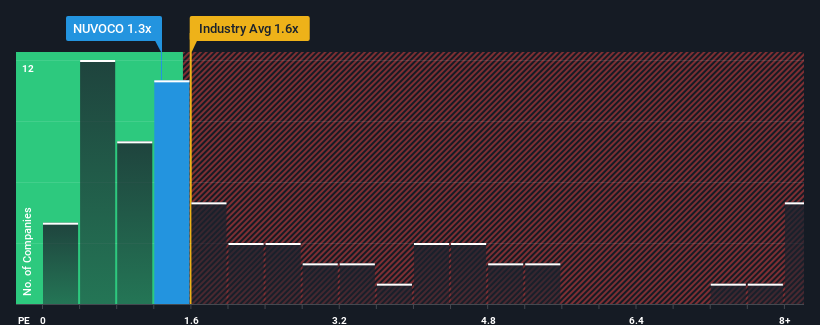

With a median price-to-sales (or "P/S") ratio of close to 1.6x in the Basic Materials industry in India, you could be forgiven for feeling indifferent about Nuvoco Vistas Corporation Limited's (NSE:NUVOCO) P/S ratio of 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Nuvoco Vistas

How Nuvoco Vistas Has Been Performing

With revenue growth that's inferior to most other companies of late, Nuvoco Vistas has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Nuvoco Vistas' future stacks up against the industry? In that case, our free report is a great place to start.How Is Nuvoco Vistas' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nuvoco Vistas' to be considered reasonable.

Retrospectively, the last year delivered a decent 7.5% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 94% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 8.9% as estimated by the analysts watching the company. With the rest of the industry predicted to shrink by 8.2%, that would be a fantastic result.

In light of this, it's peculiar that Nuvoco Vistas' P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Nuvoco Vistas' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Nuvoco Vistas currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Nuvoco Vistas (1 makes us a bit uncomfortable!) that we have uncovered.

If these risks are making you reconsider your opinion on Nuvoco Vistas, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nuvoco Vistas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NUVOCO

Nuvoco Vistas

Manufactures and sale of cement and building materials products in India.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives