Krishana Phoschem Limited's (NSE:KRISHANA) Shares Climb 27% But Its Business Is Yet to Catch Up

Krishana Phoschem Limited (NSE:KRISHANA) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 25%.

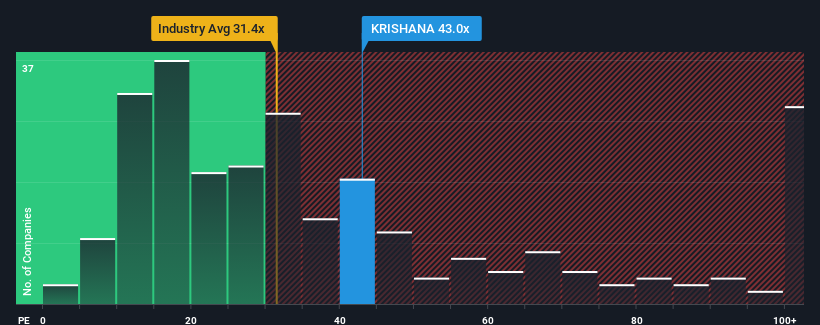

After such a large jump in price, Krishana Phoschem may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 43x, since almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Krishana Phoschem as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Krishana Phoschem

How Is Krishana Phoschem's Growth Trending?

Krishana Phoschem's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 49%. Pleasingly, EPS has also lifted 67% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Krishana Phoschem's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Krishana Phoschem's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Krishana Phoschem currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 3 warning signs we've spotted with Krishana Phoschem (including 2 which are potentially serious).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Krishana Phoschem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KRISHANA

Krishana Phoschem

Engages in the manufacture and sale of fertilizers and chemicals under the Annadata and Bharat brands in India.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives