David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Kataria Industries Limited (NSE:KATARIA) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Kataria Industries's Debt?

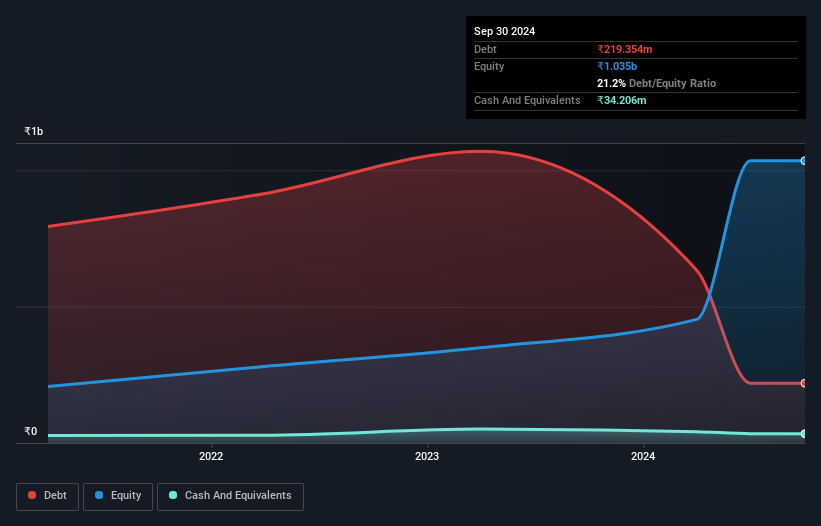

You can click the graphic below for the historical numbers, but it shows that Kataria Industries had ₹219.4m of debt in September 2024, down from ₹633.7m, one year before. However, because it has a cash reserve of ₹34.2m, its net debt is less, at about ₹185.1m.

How Healthy Is Kataria Industries' Balance Sheet?

We can see from the most recent balance sheet that Kataria Industries had liabilities of ₹295.0m falling due within a year, and liabilities of ₹29.6m due beyond that. Offsetting these obligations, it had cash of ₹34.2m as well as receivables valued at ₹791.2m due within 12 months. So it can boast ₹500.9m more liquid assets than total liabilities.

It's good to see that Kataria Industries has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders.

View our latest analysis for Kataria Industries

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Kataria Industries has a low net debt to EBITDA ratio of only 0.82. And its EBIT easily covers its interest expense, being 43.8 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On the other hand, Kataria Industries's EBIT dived 13%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kataria Industries's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Kataria Industries's free cash flow amounted to 43% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Kataria Industries's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its EBIT growth rate. All these things considered, it appears that Kataria Industries can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Kataria Industries has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Kataria Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KATARIA

Kataria Industries

Manufactures and supplies low relaxation pre-stressed concrete (LRPC) strands and steel wires, post-tensioning anchorage systems, HDPE single wall corrugated sheathing ducts, couplers, and aluminum conductors worldwide.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives